FREE TRAINING

What is Real Estate Crowdfunding?

Learn how to build wealth and earn passive income in real estate while someone else does all the work.

The Ultimate Guide to Real Estate Crowdfunding

By Adam Gower Ph.D.

Welcome! Thanks for your interest in crowdfunding and real estate. Crowdfunding is one of the most innovative ways to invest in real estate.

It opens up multiple avenues for identifying potentially profitable investment opportunities and lets qualified investors fund the projects and invest in real estate assets. It is revolutionizing the real estate industry.

The idea is that a large number of people can invest a small amount, which, when combined, becomes a significant sum of money. Soon a small number of small investments can create a large total investment.

In real estate, this means that the person raising the money is able to raise significant sums of money by going beyond either their usual sources which might include friends and family, institutional capital, or private equity. The key is igniting people’s passion and getting them to invest their money to as an alternative option to their usual investment preferences, like stocks and bonds.

Potential Drawbacks of Crowdfunded Real Estate Investing

Though crowdfunded-based real estate investing may appear simple, it is, in fact, quite complex. At its most basic level, crowdfunding is pooling a large number of relatively smaller investors to create large capital resources.

Real estate, however, is a multi-layered industry and you must understand the complexities. You have multiple options when investing in real estate through crowdfunding, so you must have a firm grasp before you invest.

This guide is designed to help you understand investing in real estate through crowdfunding. The first part of the guide discusses the history of real estate investing and the adopted of legislation to legalize crowdfunded real estate investing.

The second half of the guide is an overview of investing in real estate through crowdfunding and is designed to help you make smart investment decisions. It lets you start down the path of investing in real estate. When combined with a savvy understanding of the real estate and business, the guide will help you identify and invest in quality real estate ventures.

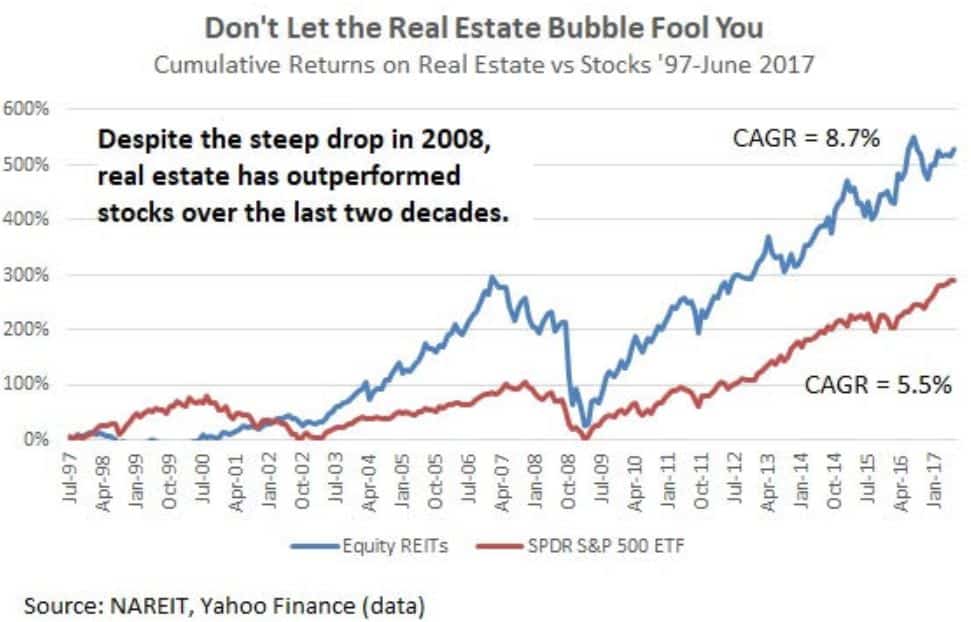

Real estate has consistently outperformed the stock market in returns to investors and though it does not substitute for stocks and bonds, it provides for an important component in a diversified portfolio.

History of Crowdfunding

For centuries, businesses and organizations have recognized the value of tapping into a larger network. They saw the need to expand an operation and bring more capital and experience to a venture. According to historians, the first public use of crowdfunding was the “The Longitude Prize.” In 1714, the British government was faced with a problem and used a form of ‘crowdsourcing’ to find a solution.

The practice evolved and traveled with the settlers across the Atlantic. As bankers and financiers in the 19th century capitalized the railroad network that crisscrossed the nation, they habitually solicited investors from the general public to participate in the syndicates they formed to finance these ventures.

In recent times, the concept is said to have been first referred to in a 2006 article in Wired magazine by Jeff Howe. In the article, Howe discusses ways the companies were using the power of the crowd to gather photos and scientific insights for specialty projects. The term has evolved to include a way of raising money by seeking online investment.

Companies like GoFundMe, Kickstarter and others have created an open forum for people to raise money for starts up as well as social causes. For example, a legal defense fund raised $22 million in 2018 through crowdfunding. While hard numbers can be difficult to come by, one source says $34 billion has been raised globally through crowdfunding.

Securities Act of 1933

In 1933, Congress passed the Securities Act of 1933. It came after the stock market crash of 1929 and was designed as a way to protect investors. The Act was concerned with securities investments, making the seller of a security subject to numerous stringent anti-fraud provisions and disclosure requirements. Under the Act, investors must have adequate information to make an investment decision, especially when it came to the sale of securities.

The Act mandated that the Securities and Exchange Commission regulate the entire process, and this created huge expenses and legal work for companies wanting to offer securities to the general public – in simple terms, it meant all companies - including those formed to develop and improve real estate - had to conduct an IPO if they wanted to advertise to the public.

This directly impacted the real estate industry also because real estate developers technically sell shares in their company when soliciting equity investments. The effect of this was to make the process of capital formation in the real estate industry a private affair. Based in the 1933 rules, real estate investment securities could be sold provided the seller had a pre-existing relationship with the investor. If such a relationship existed, then a developer would not trigger the need for formal registration with government agencies.

That meant real estate investments were usually done within a closed circle of individuals or qualified institutions.

"The 1933 Act created a world where real estate developers and syndicators had, what you might say, was a ‘little black book’ in which was contained the names of wealthy individuals and institutions they had direct relationships with and who invested with them."

The project team would meet privately and make a presentation to these potential investors and there was really no way for the average individual to break into the world of private real estate investment, because they were based on personal relationships. No advertising of the investment was allowed.

What is Real Estate Crowdfunding?

Investors have always enjoyed good returns from real estate investments. According to industry data, since 1971, the average annual return from Real Estate Investment Trusts, or REITs, is 9.72 percent. In general, since 2000, real estate has returned 10.71% annually while the stock market has returned 5.43%.

However, a recent poll found that many Americans see more obstacles to investing in real estate versus stocks. That is because historically real estate investments were more of a closed network than stocks and particularly than mutual funds. Over the last 20 years, the Internet has revolutionized the stock market, but up until recently it has not made significant changes to the investment in real estate.

In the past, investment capital was pooled in real estate through syndications. As Edward N. Gadsby, chairman of the SEC, said in 1960:

“(A real estate syndicate) is nothing more or less than a group of investors who join together and pool their funds as a private venture to purchase a specific piece of real property.”

Indeed, until 2012, the pooling of money was through private placement of investment, which avoided the need for securities regulations and the Securities Act of 1933.

Real estate investing through private syndication has a long, rich history in the United States and benefited both the investors and the developers. Crowdfunding takes the idea and makes it public and transparent. Crowdfunding of real estate takes Gadsby’s idea of syndication and expands it. It opens the process up and makes the method more public through the Internet and advertising.

"Crowdfunded real estate investing takes the power of the Internet and technology and makes real estate investment accessible and scalable for the private investor. The innovation has the power to completely transform real estate investing, and the way the developers fund individual projects."

Jumpstart Our Business Startups (JOBS) Act 2012

When the 2008 crash came, Congress and President Obama sought innovative ways to spur economic growth. Because small businesses have historically been a driver of economic activity, Congress looked at legislation that reduced the regulatory burden for small investors. Crowdfunding has become a huge part of the discussion.

That conversation started in 2010 when several people got together, including Jenny Kassan, who was at the Sustainable Economies Law Center, who submitted a petition to the SEC that was to become the most highly commented petition in the agency’s history . Federal law did not allow money raised by small investors through crowdfunding to get equity in return, and she wanted to change the law.

" We propose a new exemption for securities offerings up to $100,000 with a limit of $100 per investor,” she said, and though her motivation was entirely focused on small businesses, it was, unexpectedly, the real estate industry that was to benefit the most.

The group drafted a petition and submitted it to the Securities and Exchange Commission requesting the new exemption. They argued that the Securities Act of 1933 “impose considerable hurdles on small businesses.”

A lobbying group called StartUp Exemption was also formed at the time and several members of congress, including Rep. Patrick McHenry, of North Carolina, and Eric Cantor, of Virginia, saw crowdfunding as a new way for businesses to access capital. Eventually, the White House and members of congress rallied around the $1 million and $10,000 cap on crowdfunded investments.

Leaders of The Crowd

Conversations with Crowdfunding Visionaries and How Real Estate Stole the Show

Discover how laws that gave us crowdfunding were solely meant to finance small companies and yet inadvertently opened the doors to allow you to invest in real estate like never before.

Read the book and listen to the actual conversations.

While several different forms of the legislation were introduced, Congress eventually passed the Jumpstart Our Business Startups (JOBS) Act in 2012. They directed the Securities and Exchange Commission to rewrite the rules under crowdfunding and investments. President Obama signed the law, opening up a new era of real estate investing.

“For the first time, ordinary Americans will be able to go online and invest in entrepreneurs they believe in,” Obama said during the signing ceremony. “This bill represents exactly the kind of bipartisan action we should be taking to help the economy.”

Crowdfunding - Accredited versus Non-Accredited Investor

While opening up the real estate syndication industry to crowdfunded investing, the law still regulates certain aspects of the activities. The federal government maintains, for example, a distinction between two different classes of investors — accredited and non-accredited.

"The difference is in the financial wherewithal of the investor. Accredited institutions are high net-worth individuals and institutions, as opposed to the non-accredited investor, who is a single individual who does not meet net-worth and income requirements. "

The idea is that the accredited investor is a more sophisticated investor and can afford to make more risky investment decisions. They have more money to lose and will not be risking their entire net-worth. In general, an accredited investor is someone with a net-worth of at least $1 million not including their primary residence; or who has income exceeding $200,000 or joint income with a spouse exceeding $300,000. A reasonable expectation must also exist that the income levels will continue for the foreseeable future.

An accredited investor can also be:

-

- A bank, insurance company.

- A registered investment company.

- A business development company or small business investment company.

- An employee benefit plan.

- A tax-exempt charitable organization, corporation, or partnership.

- A director, executive officer, or general partner of the company selling the securities.

- An enterprise in which all of the equity owners are accredited investors.

- A trust with assets of at least $5 million.

The threshold does place some financial limits on the ability of large projects to raise significant capital through crowdfunding and you need to understand the regulations and the different types of crowd-sourced investments before making an investment decision.

An excellent resource for learning more about this can be found at the SmallChange website – one of the only fully regulated ‘funding portals’ that specializes in crowdfunding under Regulation CF (for Crowdfunding) under the 2012 Act.

Get access to our FREE weekly newsletter exclusively covering the latest updates from the real estate crowdfunding world

Different Types of Investments Under JOBS Act

Rule 506 of Regulation D

In 2013, the Securities and Exchange Commission released the first new regulations on crowdfunding. The rules eliminated the 80-year ban on public solicitation of investments and quickly became a popular tool to raise capital within the real estate and start-up communities. It creates a whole new avenue for capital to flow through the economy.

Regulation D has two different avenues for crowdfunded investing. Under Rule 506(b) a developer can invest unlimited amounts of capital from accredited investors and up to 35 non-accredited investors. The non-accredited investors must be considered “sophisticated” investors.

No advertising of the actual deal is permitted. Developers can take the investor’s words of being accredited unless the developer believes the investor is lying. No advertising or general solicitation is permitted, but an unlimited amount of money can be raised.

The other was Rule 506(c), which is restricted to just accredited investors. The developer or investment company is required to take reasonable steps to verify that the investor qualifies as an accredited investor. This means that the developer or company raising the money, though they can technically do it themselves, most commonly use third party verification of the status of an investor.

The reviewing documentation includes evidence such as W-2s, tax returns, bank and brokerage statements and credit reports. Under 506(c), general solicitation to the public through open advertising on the Internet – and any other means of advertising – is permitted.

Title III

In 2016, the second part of the JOBS Act went into effect. Regulation Crowdfunding (Reg CF) opens up crowdfunding to non-accredited investors. In theory, the developer or real estate company can seek investments from an unlimited number of investors to reach its funding goals, but the amount of money is limited.

A developer can only raise $1 million in a 12-month period. The mechanism is often used in conjunction with other sources of funding.

Furthermore, non-accredited investors are only allowed to invest 5% of their annual income if they make less than $100,000 a year. Platforms are using this section of the code to allow non-accredited investors access to the new technology. Reg CF, while it opens up investment to non-accredited investors, has been criticized by some in the real estate industry who argue $1 million cap is too low, because most real estate ventures require significantly more capital. Some have suggested raising the cap to $5 million.

Regulation A+

The final part of the crowdfunding regulation authorized by the JOBS Act known as Regulation A+, which is a form of simplified, expedited, stripped down IPO. It is broken down into two different tiers. In tier one, the company can raise up to $20 million from investors. The group can advertise the investment offering publicly, and no limits exist on individual investments. The second tier allows up to $50 million to be raised, and no limits are placed on individual investments. However, it does require a financial audit and other disclosure requirements that make Reg A+ offerings more complex issues than Reg D offerings, but considerably easier than a full-blown IPO.

Given the expanded use of Regulation A+ by real estate syndicators, the real estate industry is one of the top industries to take advantage of the regulations, according to a white paper by the Securities and Exchange Commission.

However, the agency is skeptical about the continued use of Regulation A+ in crowdfunding given the “risk factors and valuation challenges associated with such securities and whether additional unregistered online REITs enter the Regulation A market.”

[Oops. Sorry. Wrong image. The 'Reg A' laws as promulgated under the JOBS Act of 2012 are an entirely different kind of 'Reg A' than portrayed in this image. AG]

Do You Need to be an Accredited or Non-Accredited Investor?

You can invest in real estate through crowdfunding as both an accredited and non-accredited investor. Some websites have strict requirements on using their platform. They conduct interviews and want to see financial information before a person can use their platform. Other platforms have created investment vehicles for non-accredited investors where as little as $100, or even less, is required for the minimum investment.

The new regulations have transformed real estate investment in the United States, and the number of avenues for investors to place money in real estate has snowballed.

While opportunities exist for both accredited and non-accredited investors, you just need to take the time to research each of the platforms and look at the options.Real estate investing is the perfect way to diversify a portfolio and gain access to other different investments besides the stock market.

Access a full list of all real estate crowdfunding websites here.

How Does Real Estate Crowdfunding Work?

Like any investment venture, crowdfunding investment in real estate starts with research. Real estate is an extremely diverse industry and the discerning, prudent investor must understand the industry and the different opportunities. Much like mutual funds, a variety of different investment vehicles have been created for the real estate crowd investor.

With the proper research and work, real estate crowdfunded investing offers the potential to grow a portfolio and generate wealth. A person can take money and invest in the burgeoning real estate economy. The challenge for any investor who uses crowdfunding is to understand the real estate market. Real estate has many different forms of investment and crowdfund investing offers opportunities within many of the variations.

To begin, you need to select a platform based on your financial ability and net-worth.

You have to find a platform that allows you to participate, as an investor, whether you are accredited or non-accredited. But be careful. A large number of companies have entered the crowdfunding industry and you want to choose a platform that is transparent and credible. The platform must provide the necessary data to help you make an informed financial decision. You do not want to put your hard-earned money into an unwise investment.

For more information and to gain access to:

- Guided tour of 8 real estate crowdfunding websites

- FREE: Complete list of every real estate syndication website

- FREE: 10 things to look for in real estate contracts

- Access to advanced real estate investment training

Additionally, you must determine your level of risk tolerance if you are to diversify your investments into real estate. If you have $500,000 to invest, you may want to consider investing across a range of products to spread the risk. Otherwise, if you are invested in just one investment that fails, you could lose all the money you worked so hard to earn.

Benefits of Real Estate Crowdfunding

The regulations permitting crowdfunding has completely revolutionized the real estate syndication industry. Real estate companies and developers now have innovative new approaches to access capital, and investors have a new, technologically driven way to invest money in real estate.

The new method has several advantages over traditional real estate investment models.

Openness

No longer does a developer’s or real estate professional’s little black book govern who can invest in the best real estate opportunities in America. Syndications are now out in the open and increasingly available for public access. You can review the information and do additional research. You do not have to be invited to an exclusive meeting, or be connected to the right people.

In a crowdfunding environment, the information should be concise and presented in a logical manner. The documents are not created to satisfy lawyers and regulators at the Securities and Exchange Commission.

Good platforms and developers will concisely lay out their need for investment and the expected return on investment, as well as providing you with copious opportunities to learn about who they are, including their investment philosophy and value proposition.

Decreased Need for Huge Amount of Capital

Crowdfunding reduces one of the major barriers to entry into real estate investing — the need for a large minimum investment. As an investor, you have access to quality real estate investment for significantly smaller minimums than historically have become commonplace. You can choose to invest an amount of money that is reasonable, given your individual financial situation.

Unlike other forms of financial investing, you do not need to utilize a broker or professional investment manager. With a couple of clicks, you can start your journey in real estate investing.

No Need to Collect Rent

In the past, the easiest way to investment in real estate was to buy rental properties. While that can be a positive investment, it also means you are dealing with tenants and collecting rent. With a crowdfunded investment, you are removed from this laborious process.

The property management company or developer is the landlord and, in a real estate crowdfunded deal, it is they who collects the rent. You do not have to call tenants when they are late on paying rent or find quality tenants when someone moves out. You are strictly an investor which means that you don’t deal with the day-to-day operations of collecting rent and managing income properties, but you still share in the proceeds when those projects are profitable.

Create a Diversified Portfolio

With any investment portfolio, diversification across different asset classes with different risk-reward profiles is generally considered to be desirable.

Real estate is a proven ‘alternative’ asset (to stocks and bonds) that has its own risk-reward profile. The stock market is obviously the most commonly used place to invest, and real estate lets you diversify your investment portfolio into this asset class. Throughout its history, both the stock market and real estate markets have gone up and down with economic cycles, and the wealthiest Americans generally hold between 10%-20% of their wealth in real estate.

Speed

In today’s Digital Age, investing in real estate has become almost a one-click process. With crowdfunding, you can purchase an investment immediately. All it takes is an internet connection and a mouse. You can conduct research and make a purchase in a matter of hours or minutes, depending on the platform.

The JOBS Act has made the movement of money into real estate investing simple and straightforward which, while it comes with the great benefit of access, is also reason to pause, reflect, and do your research before jumping in too quickly.

For more information and to gain access to:

- Guided tour of 8 real estate crowdfunding websites

- FREE: Complete list of every real estate syndication website

- FREE: 10 things to look for in real estate contracts

- Access to advanced real estate investment training

What are Good Real Estate Crowdfunding Returns?

When you invest in real estate through a crowdfunding platform, you want a solid return on investment – one that compensates you for the additional risks you are taking and the inevitable lack of liquidity.

A lot depends on the type of project you invest in, but the most common preferred return is 8% (40% of all projects) followed by 10% (30% of all projects).

In general, the kinds of returns you find on real estate crowdfunding websites or those offered by independent sponsors should be consistent with what you find in the broader real estate industry. Returns will vary according to the type of real estate you are investing in and the stage the real estate cycle during which you are investing.

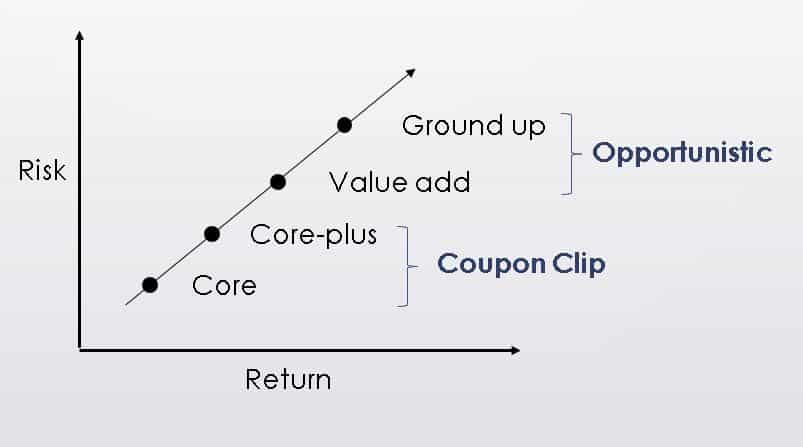

For example, core and core-plus real estate (large downtown, trophy properties with credit tenants) are going to produce lower returns than value add, opportunistic, or ground up developments – but also have considerably lower risk profiles.

Source: Principles of Real Crowdfund Real Estate Investing, The Four Development Strategies

Projected returns are likely to be higher in earlier stages of a recovery (post recession) where risk is also perceived to be higher (memory of recession) but are in fact not so high (irony) because the recession is, in fact, over. Returns tend to come down further as the cycle lengthens despite (more irony) risks increasing (of crashing into another recession). Sites such as PeerStreet, for example, were offering 12-14% returns on their hard money loans earlier in the cycle, but as the market cycle has lengthened and competition intensified, they are only offering 6-9%.

How to Make a Real Estate Crowdfund Investment

When making a crowdfunded real estate investment, you want to first decide the amount of money for investment. Your decision should not be based on the total size of your investment portfolio and how you want to diversify.

Of course, you must ask a professional investment advisor, lawyer, and/or accountant for advice tailored to your specific circumstances.

In real estate crowdfunding minimum investments are much lower than previously have been required and this opens up the opportunity for you to expand your investments into real estate in a way even your financial advisor may not have considered.

Get access to our FREE weekly newsletter exclusively covering the latest updates from the real estate crowdfunding world

Credible crowdfunding platforms will provide you with detailed information about the opportunities they offer, allowing you to make an informed decision. You should be able to see the historical returns a sponsor has delivered, and know what their projected returns are going to be so you can decide whether a particular investment makes sense. You should continually get updated data on the investment after you make a purchase, so you can monitor the activity.

Besides, the information on the platform, you can also find information on other websites. Numerous organizations track construction and real estate activity across the country. You might think that investing in an apartment complex in a college town is a smart choice or an office complex in a region that is experiencing large amounts of growth. The investment decision has to make sense both from a micro and macro perspective.

Related: Sponsor Fees and the Motivating Factor in Real Estate Investing

Debt versus Equity Investment

When making a real estate investment, you must decide whether to take a debt or equity position. While both can deliver solid returns on investment, each has subtle differences. You need to understand the arrangement a particular investment is offering before you decide.

Equity Investment

An equity investment is when you are given an ownership stake in the development or real estate company.

Pros:

-

-

- You receive a share of the net profits.

- Can receive ongoing cash flow payouts.

- Lower fees, often 1% to 2%.

- Larger share of the crowdfunding market.

-

Cons:

-

-

- You are the second in-line to receive payment

- Higher risk, you bear the risk of loss

- Generally a longer investment period

-

Debt Investment

A debt investment is when you are loaning money, and a developer, often a fix-and-flip developer, is taking on debt.

Pros:

-

-

- Time is shorter.

- First in line to receive payment.

- Less risk.

- More predictable.

-

Cons:

-

-

- Returns are lower.

- Generally the fees are higher, around 2%.

- Return is based on the interest rate of the loan.

-

Leaders of The Crowd

Conversations with Crowdfunding Visionaries and How Real Estate Stole the Show

Discover how laws that gave us crowdfunding were solely meant to finance small companies and yet inadvertently opened the doors to allow you to invest in real estate like never before.

Read the book and listen to the actual conversations.

Passive versus Active Investor

If you want to invest in real estate, you need to decide what type of investor you want to be. You can either buy real estate directly and manage the entire development process yourself – the ‘active’ option. Or you might decide to be a passive investor and purchase an investment through a crowdfunding site or as a partner with a professional developer. A lot depends of your abilities, and the level of risk you are willing to take.

Passive real estate investing does not expose you to one major risk that active investing does i.e. you don’t have to sign on bank loans if you are a passive investor. To look at the downside, this restricts the amount you can lose to only the money that you invest.

If you take the active route and buy and develop real estate yourself, chances are you are going to have to sign on debt and guarantee bank loans which could mean, if things don’t go as you planned, that you lose not only your investment of time and money, but also be liable for any repayment to the bank of the entire loan amount.

Direct or Indirect Investments

When investing on crowdfunded real estate, you generally have two different options — direct or managed – which are similar in many ways to the concepts of passive vs. active investing.

Direct

A direct investment is typically associated with traditional real estate investing. You invest in a partnership or purchase a piece of property directly.

Direct investing gives you a greater sense of control, because you select the specific property or project. You are, as they say, in the driver’s seat. You are empowered as the investor to place your money where you want, and it gives you the chance to become more involved in a project.

With direct investing, you select the location and type of project that you want. You can choose, for example, a commercial warehouse project in Iowa or an office building in Nevada. Everything is in your control.

You choose the financial structure of the investment and the length of time you want the money held within the investment. In short, this option requires a considerable investment of not only capital but also of your time – you are the boss. If you prefer control, this is your best option.

Indirect

With indirect investing, you are purchasing shares in someone else’s project. You are turning control over to the person or organization that controls your money.

They might invest in a variety of different areas to maximize returns and will provide detailed information to you so you can check their due-diligence work-product before investing – saving you the trouble of actually having to conduct original due diligence yourself.

Professional real estate developers are in the business of owning and managing real estate properties, and of providing investors with dividends and profit sharing in return for their capital investments.

With indirect investment, you have little or no control over the process of real estate development, but once you have made your investment you have no further day-to-day management responsibilities so it is a lot less time consuming for you.

For more information and to gain access to:

- Guided tour of 8 real estate crowdfunding websites

- FREE: Complete list of every real estate syndication website

- FREE: 10 things to look for in real estate contracts

- Access to advanced real estate investment training

Real Estate Crowdfunding Statistics

Crowdfunding is expected to completely transform real estate syndication over the next decade. Hundreds of companies have successfully raised money through crowdfunding and more and more are looking to crowdfund their projects for capital.

Here are a few statistics:

- Jilliene Helman, online real estate investing expert, has predicted that the United States commercial real estate crowdfunding could grow to $10 billion in five years.

- By 2025, the crowdfunding industry as a whole is anticipated to be valued at more than $300 billion.

- Real estate crowdfunding grew 156 percent in 2014, just breaking the $1 billion mark. Campaigns ranged in size from less than $100,000 to over $25 million.

- In 2014, North America stood as the largest region by funding volume at 56 percent market share, compared with Europe at 42 percent.

- Real estate is one of the fastest growing sectors for crowdfunding. In 2016, real estate crowdfunding grew to a valuation of around $3.5 billion.

- A 2016 industry report estimated that year’s overall total US real estate crowdfunding activity at $3.5 billion.

- The World Bank predicts that by 2025 the crowdfunding industry as a whole will be worth $93 billion.

Sponsor Statistics

There have been many notable successes in real estate crowdfunding from the sponsor perspective, with dollars raised increasing at an exponential rate. Here are three of recent examples of how successful real estate crowdfunding has been for both real estate developers as well as for real estate investors.

- Origin Investments raised $105 million in 17 hours

- In one webinar, J. Jeffers & Co raised $14 million through real estate crowdfunding from 400 investors

- Crowdstreet, the real estate crowdfunding marketplace, reached the $500 million raised in April 2019

What are the Best States for Crowdfunding Real Estate?

For any real estate investment, you need stability. Many markets across the country — Phoenix, Miami, Las Vegas, San Francisco, have seen huge fluctuations in real estate values.

Before the global economic crisis of 2008-2009, these regions saw huge asset appreciations, but lost significant value after the crash. That can make these regions less predictable and attractive for real estate investment.

Institutional and international investors tend to favor the major metropolitan areas within major coastal states, like Los Angeles and San Francisco in California, and New York City in New York. Other major MSAs (Metropolitan Statistical Areas), like Chicago are also favored ‘gateway’ cities for institutional investors. These cities that command the attention of such large investors tend to provide greater stability, lower asset value declines during recessions, and faster recoveries than less populous and economically vibrant states.

That said, when pricing climbs to end-of-cycle levels, investors start looking to secondary and tertiary cities for greater value investing opportunities.

The Midwest, for example, might be a place to explore for real estate investments. Take Cleveland, Ohio as an example. The city saw housing prices only declined 7% during the global financial crisis of 2008-09, but prices have increased a respectable 64% since 2010, according to the Case-Shiller Housing Index.

That compares to Las Vegas, which saw housing pricing decline 140% after the crash and increase 99% since the crash. At the same time, Ohio is only ranked 16th for the cost of doing business and its unemployment has declined significantly over the last decade despite the decline in manufacturing sector.

How Much Should you Invest in Real Estate Crowdfunding?

When it comes to real estate crowding, there is no magic number on how much you should invest. The government has placed some limits on how much you can invest through crowdfunding platforms, but you really must decide the best investment decision.

Some investment advisors might say to only put 10% to 20% of your capital in real estate, but plenty of people have made a fortune through just investing in real estate.

The amount you invest can depend on your age and ability to take on risk. While real estate as a class has achieved quality returns in the past, individual investments and a change in the economy can produce undesired results. For example, real estate declined significantly during the 2008 crash.

Real Estate Crowdfunding Challenges

One of the biggest challenges with crowdfund real estate investing is trust. You need to develop a level of trust with the platform or sponsor you utilize and/or with the actual group that is seeking an investment.

The Internet makes the process more public and open, and though the methodology for establishing a relationship has changed, learning about the person you are planning to invest with is as important as it always has been. You need to begin by choosing a reputable platform and one that is open and transparent about its operations, and be sure to study everything about them.

Once you choose a platform, you are on your own when making an investment decision.

You may not be working with a professional financial advisor but asking one for advice, or asking your lawyer or accountant or other professional, is a necessary step. You have to work hard and conduct due diligence on your own. It is a new world for investors but also creates incredible opportunities.

Conclusion

Crowdfunded real estate investing is transforming the real estate industry. It is a disruptive force in an industry that has not changed in generations. You have the opportunity to access unique investments through modern technology and grow your wealth.

Crowdfunded investment in real estate projects is a brand new opportunity for investors, and now is a good time to take a closer look and to learn as much as you can about the process. Opportunities exist to invest in small and large projects, and you certainly could see a nice return on investment, but it’s up to you to conduct the research and make an informed decision.

Crowdfunded real estate investing is only going to grow and now is an excellent time to take advantage of a disruptive force in the investment community.

Newbie

If you want to build your wealth and earn passive income from real estate investing and are looking at deals on marketplace platforms or through developers online, then I recommend you start by the 8 Key Financial terms so you can understand every deal you look at.

The 8 Financial Keys are not only a great way to get started, they are also essential to understanding how you’ll make money in any real estate deal.

You’ll learn the most important financial concepts you need to know in real estate investing that apply to every type of real estate no matter the asset class (office, industrial, residential, hospitality, retail).

Intermediate Investor

If you’ve got some online real estate investments under your belt already and are beginning to receive passive income checks each month, or have been paid off with profit – or (hopefully not) are finding that some deals are not quite panning out the way you expected, then check out this page for a wealth of free resources.

Here I cover everything from beginner all the way to very advanced real estate concepts.

You’ll find podcasts with developers, researchers, professors and other industry experts, detailed articles, and lots of videos, both short and long that are all easily searchable and totally free.

Advanced Investors

I am not shy about being straightforward about real estate investing; it is exciting, lucrative, and can help you build wealth and income as part of your investment portfolio, but it is not without its risks.

As an advanced investor you know this already, so I’ve put together a webinar for you that guides you through one of the most important components of real estate investing: Real Estate Contracts – reading between the lines.

This is advanced learning and based off conversations I had with three of the top real estate attorneys in the country, combined with my own personal experience. Access it here; it could be the most important webcast you watch all year.