FREE TRAINING

What is Real Estate Crowdfunding?

Learn how to build wealth and earn passive income in real estate while someone else does all the work.

Guide to Real Estate Syndication and Best Platforms

June, 2021, Note: In my new book, UNLEASHED, which updates the research in this article, we reveal that CrowdStreet is the largest private equity real estate platform in the industry. Check out these stats:

- Total equity raised: $2 billion +

- Total Project Capitalization: $20 billion +

- Investor Distributions: $200 million +

Our research shows that while the real estate syndication industry is growing at a tremendous clip, increasing from $7 billion to $15 billion in size during 2020 alone spurred by the accelerated move to online commerce by the pandemic, CrowdStreet appears to be growing faster than the industry overall, leading the growth trend.

This article is being updated and a revised version will be published shortly, but to learn more about our latest research please see a detailed analysis in UNLEASHED, here.

Investing in commercial real estate has become a popular way for investors to diversify their portfolios, particularly given the low correlation between commercial real estate performance and the broader stock and bond markets. While commercial real estate investing is far from foolproof, it does provide some insulation against the ebbs and flows of the general market. It takes much longer for commercial real estate pricing to adjust than it does other securities, such as stocks and bonds.

Yet investing in commercial real estate isn’t so easy, particularly for those who are not well-capitalized or who lack industry connections.

This is the inherent appeal of commercial real estate crowdfunding: those with limited resources can now invest nominal sums to co-invest in institutional-quality commercial real estate alongside many other investors. Read on to learn more about real estate crowdfunding, including the best platforms serving the marketplace today.

Contents:

- What is Real Estate Crowdfunding?

- Stakeholders in Crowdfunding

- How Real Estate Crowdfunding Works

- Why Crowdfunding for Real Estate Investing?

- Factors for Choosing a Real Estate Crowdfunding Opportunity

- Review of Reviews: Best Platforms for Crowdfunding

- Requirements for Investors

- How Crowdfunding Can Affect Taxes

- Is Crowdfunding Right for You?

What is Real Estate Crowdfunding?

Crowdfunding is a concept that most people have become familiar with in recent years. In short, it is when someone solicits monetary contributions to fund a cause. You’ve probably seen innovative businesses pitch their ideas or business plans through KickStarter, or community members seeking donations for a charitable cause on GoFundMe. This is the basis of crowdfunding, which really sprung up as a result of the 2012 JOBS Act, which established ground rules for online crowdfunding.

Real estate crowdfunding is similar, except that the sponsor is not seeking donations. Instead, the sponsor is looking for investors to contribute capital toward debt, equity or some combination of both. These deals are usually featured on platforms like CrowdStreet, RealtyMogul, RealCrowd, Fundrise and others which we’ll discuss in more detail below.

One popular misconception is that real estate crowdfunding is a “new” industry niche. While the term may be new, the practice is as old as time. The nature of commercial real estate financing, which often requires millions of dollars in debt and equity, has always required the aggregation of capital from multiple sources to finance deals. Most sponsors would line up traditional debt financing for 60-80% of their total project costs, and then seek equity investments from a host of limited partners.

The only thing that is “new” about pooling capital for commercial real estate deals is that the 2012 JOBS Act allowed sponsors to market to prospective investors in new ways. Prior to 2012, real estate sponsors were barred from general solicitation which meant, effectively, that they could not advertise or use social media to promote their companies or deals. Today, real estate deals can be crowdfunded with almost no restrictions of any kind. That means real estate developers can market their deals to people all over the world, using any form of media, without having a pre-existing relationship with those who choose to invest – another restriction of the pre-2012 JOBS Act era. This has democratized the commercial real estate industry, allowing both accredited and non-accredited investors to invest in deals they would never have had access to before.

Check out the ultimate guide to crowdfunding real estate and learn from the experts.

A FREE FOUR-DAY COURSE

The 8 Financial Keys to Real Estate Investing

Stakeholders in Crowdfunding

There are generally three stakeholder buckets involved in real estate crowdfunding: sponsors, the crowdfunding platform itself, and individual investors.

Sponsors

Real estate crowdfunding would not be possible without sponsors being willing to raise capital in this manner. The project sponsor is the person, or team of people, behind the real estate deal. The sponsor is responsible for all day-to-day activities relating to the deal, from acquisition to financing, from redevelopment, lease up, stabilization and eventually refinance or disposition. The sponsor will provide all offering materials for prospective investors to consider, including the initial underwriting and deal terms.

When evaluating an investment opportunity, investors will want to carefully vet the sponsor’s qualifications. Consider the sponsor’s experience, particularly with the product type and in the geography of the proposed deal. Look at how the sponsor has executed deals in both bear and bull markets. Challenge the underwriting assumptions and be sure the sponsor has accounted for all costs and potential liabilities. An otherwise exciting deal can quickly unravel with an unqualified sponsor at the helm.

Crowdfunding Platform

Even though crowdfunding has only been available online for less than a decade, we’ve already seen platforms begin to evolve. The initial wave of real estate crowdfunding platforms served as middlemen. They were essentially a technological solution for connecting sponsors and prospective investors, nothing more.

Today, crowdfunding platforms have become more nuanced in many ways. Some only feature certain types of deals (e.g., debt vs. equity). Others offer opportunities to invest via different vehicles (e.g., in eREITs or funds vs. direct investment into a specific deal).

Increasingly, there are platforms that are hosted by the sponsor directly – not a third party. The sponsor will establish their own platform for real estate crowdfunding. This takes out the middleman and allows the sponsor to connect directly with their investors, providing the resources and technology to allow people to invest with them directly.

Investors

Investors are the third and equally important group of crowdfunding stakeholders. The 2012 JOBS Act allowed accredited and non-accredited investors to participate in real estate crowdfunding. It took some time for the regulations under the Act to be promulgated and it was not until 2015 that the SEC finally opened real estate crowdfunding to non-accredited investors through both Regulation CF (which stands for Crowd Funding) and Regulation A+ (known colloquially as a ‘mini-IPO’) to come into use. Today, nearly anyone can invest in real estate crowdfunding, sometimes with as little as $10. At the opposite end of the spectrum, we’re starting to see institutional investors invest in crowdfunded deals as well.

Each platform can set its own requirements re: whether they want to accept accredited vs. non-accredited investors, so individuals will want to consider these requirements before spending too much time evaluating deals that they may ultimately not be eligible to invest in.

How Real Estate Crowdfunding Works

At a most basic level, real estate crowdfunding works by aggregating capital from multiple investors and then deploying that capital into a specific real estate project or fund. In practice, each real estate crowdfunding platform and sponsor operates a bit different.

For example, some platforms function like marketplaces (e.g., CrowdStreet or RealtyMogul) that connect sponsors and investors. Think of what the MLS (multiple listing service) is for residential real estate, or what Costar is for commercial real estate and you can think of the crowdfunding platforms as being their marketplace cousins. The primary difference is that unlike the MLS or Costar that function to allow the listing and sale of whole buildings, the real estate crowdfunding marketplaces allow for the listing and sale of small shares in whole buildings.

This is why crowdfunding marketplaces are governed by securities laws under the Securities and Exchange Commission (the SEC) – they are not selling whole building they are selling shares in companies that own buildings i.e. they are marketplaces where ‘securities’ are traded (technically) and not buildings.

Some platforms actually co-invest in the deals featured on their websites, even as a third-party facilitator. Increasingly, some sponsors host and manage their own online marketing efforts, presenting only their own deals independently to prospective investors, and in contrast with marketplaces that offer multiple deals at the same time from multiple sponsors.

Most platforms are designed to raise capital for one of three purposes: to raise debt, to raise equity, or to raise some combination of both.

Debt Platforms: Several websites have emerged that help raise debt for real estate projects. Patch of Land is one such example.

Investors contribute to an offering, and once funds are raised, the money is used to make loans on commercial real estate deals. The structure of these deals can vary, but they tend to be short-term construction or mezzanine loans that promise yields as high as 10% to 18%. Returns are high given the inherent risk associated with some of these deals, along with the fact that these loans are not always secured by the asset itself.

Equity Platforms: Equity platforms are perhaps the most successful segment to date of real estate crowdfunding, with companies offering investors a slice of real estate in many different forms. Here you find the crowdfunding marketplaces like Crowdstreet, RealtyMogul, RealCrowd and others listing and allowing the sale of shares in the individual deals of many sponsors.

There are some sponsors, like ArborCrowd, Origin Investments, KBSDirect, JamestownInvest, Feldman Equities, Trion Properties etc., who raise equity directly from investors for their own deals and who, in some cases also list on the marketplaces to further expand their reach to the investor community.

Some equity platforms, like Fundrise for example, raise money for a fund, and then the fund invests in a specific asset or portfolio of assets. Depending on how they are structured, these offerings are sometimes referred to as “eREITs”.

Debt and Equity Platforms: A third type of crowdfunding platform is one like CrowdStreet, which offers opportunities to invest in debt or equity, through a fund or by investing in a specific deal.

Are you interested in learning from a successful expert? Then check out Adam Gower, and allow him to teach you.

Why Crowdfunding for Real Estate Investing?

Although online crowdfunding for real estate investing is still a relatively new concept, it is growing in popularity (among all stakeholders – sponsors and investors alike) for good reason. Below are some of the benefits to investing in real estate crowdfunding.

Wide Reach

One of the primary benefits to real estate crowdfunding is that it allows a sponsor to reach a broader audience. Rather than pitching to one or two prospective investors at a time, often in person through boardroom-like presentations or over lunch, a sponsor can now pitch their deal to investors from all over the world. Similarly, investors benefit from having greater access to commercial real estate opportunities that would historically have been reserved for only those “in the know.”

Short Time Frame

When a lucrative opportunity arises, a sponsor often needs to move quickly. Real estate crowdfunding is one way to do that. By creating a fund, the sponsor can aggregate capital based on certain investment criteria. With that cash on hand, the sponsor can act quickly and decisively. (Keep in mind, however, that as attractive as it may be to have a fund into which you can dip as a developer to purchase assets at a moment’s notice, raising money for a fund is a lot harder than raising money for individual deals).

Sponsors who have a deal in mind already – let’s say, they have a letter of intent signed for a land development deal – can use online crowdfunding to reach more investors and line up capital in less time than they’d be able to if pitching to individual investors in person. The most famous capital raise to date has been Origin Investment’s successful raise of $110 million in just 17 hours in late 2018.

From an investor’s perspective, crowdfunding also offers the benefit of investing in deals that have a relatively short (1-3 year) time horizon. For example, while many commercial real estate syndications require a long time to complete – 5 years or more – some offer much shorter time frames. For example, where sponsors are looking for investors for a construction loan, these may be repaid in 12-18 months at a double-digit interest rate. This is a much shorter time horizon than an investor would expect if buying a commercial real estate deal independently.

Potential for Higher Returns

In order to appeal to the masses, sponsors generally have to project at least double-digit returns for prospective investors. It is not uncommon for crowdfunded deals to forecast annualized returns of 15% or more. (Keep in mind, however, that the higher the returns the higher the risk). The structure of the deal will influence actual returns. For example, mezzanine debt may be a few basis points lower than the returns expected when investing in common equity shares given the structure of a real estate waterfall. Of course, investors will always want to do their own due diligence on a deal, fact-checking the sponsor’s underwriting assumptions. It is important to keep in mind that any projected returns are forward-looking statements that can never be guaranteed.

Portfolio Diversification

There’s certainly something exciting about owning a piece of commercial real estate, but direct ownership is a lot of work. Real estate crowdfunding allows someone to passively invest in a single property without taking on the day-to-day management—duties which are instead left to the sponsor. This is a great option for those who want to learn the ins and outs of a specific market and singular property as a foray into commercial real estate investing. Learn more about crowdfunding and if you are wondering if it is legal.

Focusing on a Single Property Without Having to be a Landlord

Individual investors can use real estate crowdfunding to diversify their portfolios. Those who have already invested in real estate, perhaps in smaller deals as an active investor, may look to crowdfunding to diversify their holdings into larger projects of different product types or in different geographies. Those who have never invested in real estate (except maybe their own personal residence) may look to real estate crowdfunding as a way to passively invest in commercial property as a means of diversifying their portfolio of otherwise traditional holdings like stocks and bonds. Learn more about portfolio diversification.

Factors for Choosing a Real Estate Crowdfunding Opportunity

With so many real estate crowdfunding platforms and sponsors to choose from, most of which are structured slightly differently, it can be daunting for an investor to hone in on their first crowdfunded investment. Here are several factors to consider when choosing a real estate crowdfunding opportunity.

Risk

Investors will always want to consider their own risk profile. Those who are risk-adverse may look to invest in an eREIT or other fund that deploys capital across several investment opportunities, thereby not putting all their eggs in one basket. Similarly, they will want to consider the product type they’re investing in. Multifamily and office, for example, tend to be less risky than retail or hotels. Some geographical markets are “safer” than others, too. An investor will want to align their risk profile with the nature of the deals they are considering.

Investment Type

As noted above, there are many investment types to consider. Not all platforms, sponsors, or funds invest in the same types of deals. A particular fund, for example, may only invest in value-add apartment buildings in the Southeast. If you are looking to invest in a particular product type, using a particular investment vehicle, you’ll want to identify a platform or sponsor that specializes in those deals.

To present this in a slightly different perspective, it's the same as saying that somebody is looking in the market to earn 5% on their money, and the sponsor is offering $1.4 million. This means that they are going to be prepared to pay $28 million in order to buy that income stream of $1.4 million. So the sponsor’s cost, in this case, is $20 million. The buyer is willing to buy the net operating income stream for $28 million, so the deals are good. This is a quick way for sponsors to screen deals.

Sponsor Experience

The sponsor’s experience is perhaps the most critical factor to consider when choosing a real estate crowdfunding opportunity. Do not allow sleek marketing materials to persuade you to invest; this just means the sponsor has a good marketing team. Peel back the layers to dig into the sponsor’s experience. What experience do they have with this product type? What were their projected vs. actual returns on previous projects? Who else is on their team, and how experienced are those people? Has the sponsor weathered multiple real estate cycles? How have their deals performed during downturns? What does the sponsor perceive as the biggest project risks? The answer to these questions should guide your decision-making when evaluating various opportunities.

Fees

Different platforms, and different deals on each of those platforms, usually have a different fee structure. Consider doing a side-by-side evaluation of individual deals to learn more about the fee structures. Steer clear of any deal that has an exorbitantly high fee structure, as this will quickly eat into investors’ returns and suggests that the sponsor is motivated by fees and not by results – a misalignment of interests with their investors. At a minimum, you should account for all fees and understand how those fees are being used and be sure that they are market rate and do not serve as a motivator for the sponsor.

Target Return

A deal’s target return will depend on many factors, including the type of deal (e.g., debt vs. equity), holding period, property type, and more. An individual will want to consider a deal’s target returns relative to other investment opportunities—including other real estate crowdfunding opportunities, but also other investment types, such as stocks, bonds or private equity for non-commercial real estate transactions. Crowdfunded deals, on average, tend to be relatively high-risk, high-reward investments, so it is important that an investor is getting a return that aligns with the corresponding risk profile.

Target Holding Period

Investors will want to consider a deal’s target holding period, as this will determine when the investor can expect to be repaid, plus any interest or dividends. Most crowdfunding deals seeking equity will have a target holding period of between three and ten years, though it can certainly be more or less. The holding period for debt is often shorter, ranging from one to five years, give or take. The holding period will depend on the sponsor’s exit strategy, which is why it is important to understand the sponsor’s business plan. An investor with a short-time horizon will want to identify opportunities with shorter holding periods vs. vice versa. Note: most deals have an estimated holding period, but that period may vary depending on market conditions. In an overheated market, for example, the sponsor may see an opportunity to sell sooner than they anticipated as a means of generating higher returns for investors.

Income or No Income

When investing in crowdfunded real estate, investors can expect to be repaid their initial investment plus interest, dividends, share appreciation or some combination thereof. Most deals seek to produce some level of ongoing income stream for their investors, though it may take years before paying out that income via cash flow distributions. It depends on the sponsor’s business plan, amount of construction needed, how long it takes to stabilize the property, and so on.

Another way to earn money through real estate crowdfunding is via a profitable exit. This is when the sponsor refinances or sells a property and returns a share of the proceeds to the investors. Some deals have both interest and/or dividends as well as payouts as a result of a profitable exit.

The benefits and profitable gains of crowdfunding are numerous and what a great way to enhance and diversify your financial portfolio.

A FREE FOUR-DAY COURSE

The 8 Financial Keys to Real Estate Investing

Best Platforms for Crowdfunding

Real Estate Crowdfunding Review of Reviews:

Several crowdfunding platforms have emerged as industry leaders to fill demand among sponsors looking to raise both debt and equity for their projects

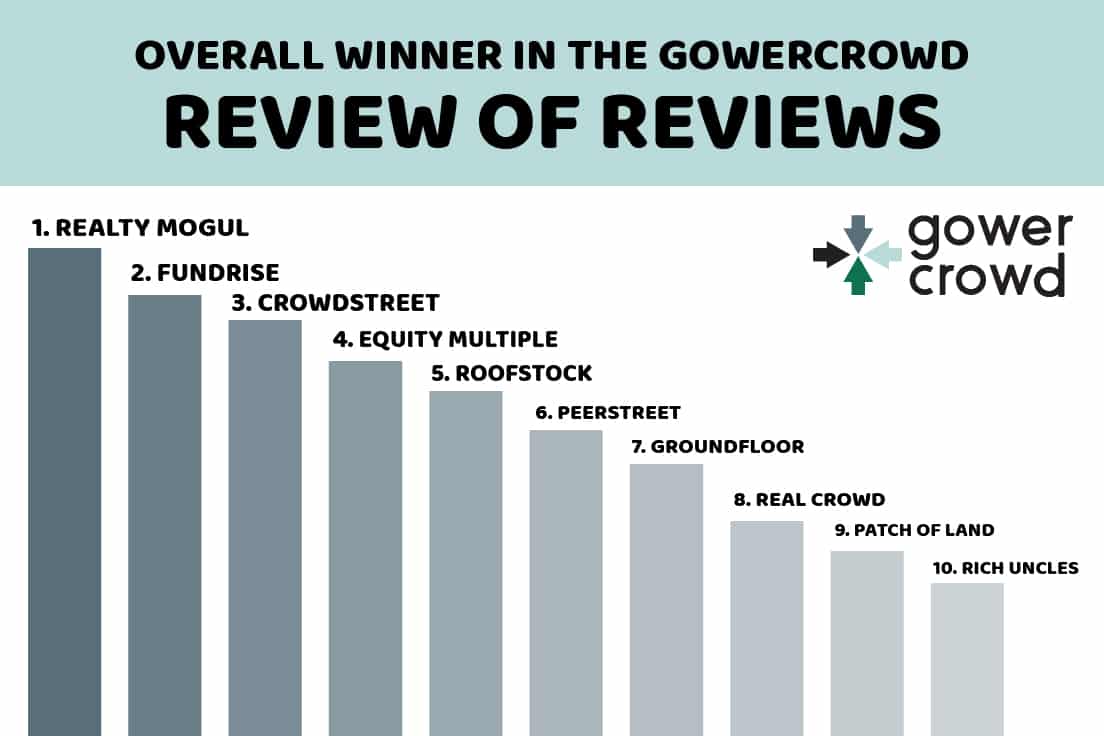

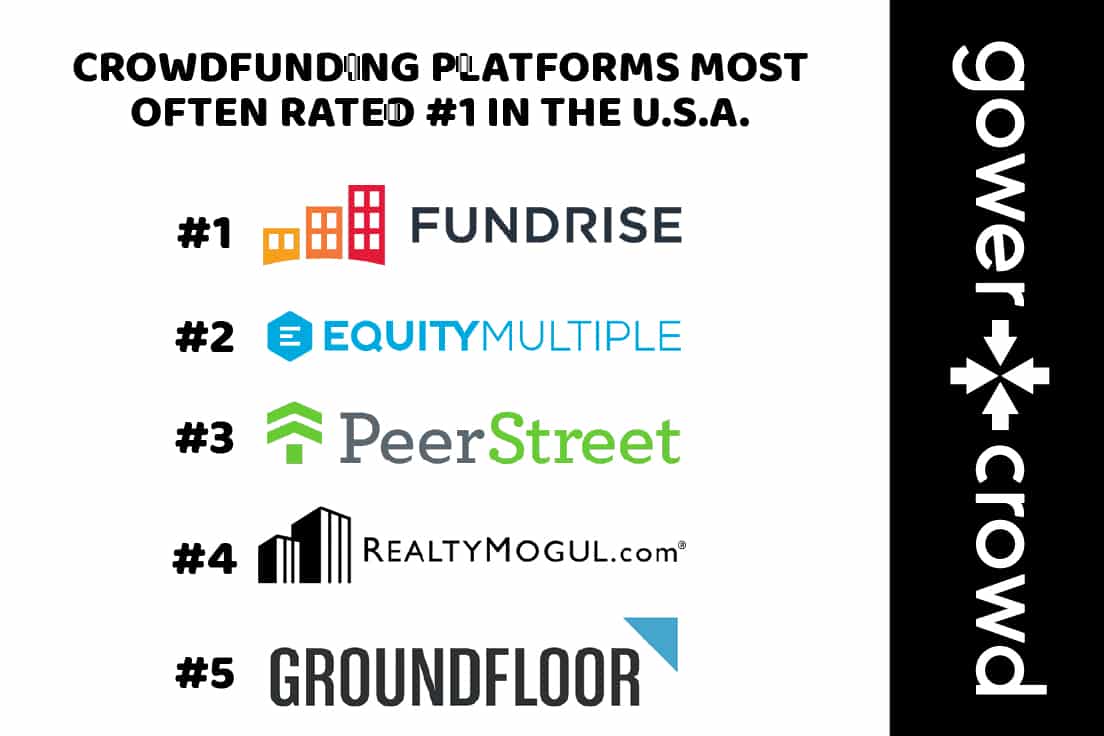

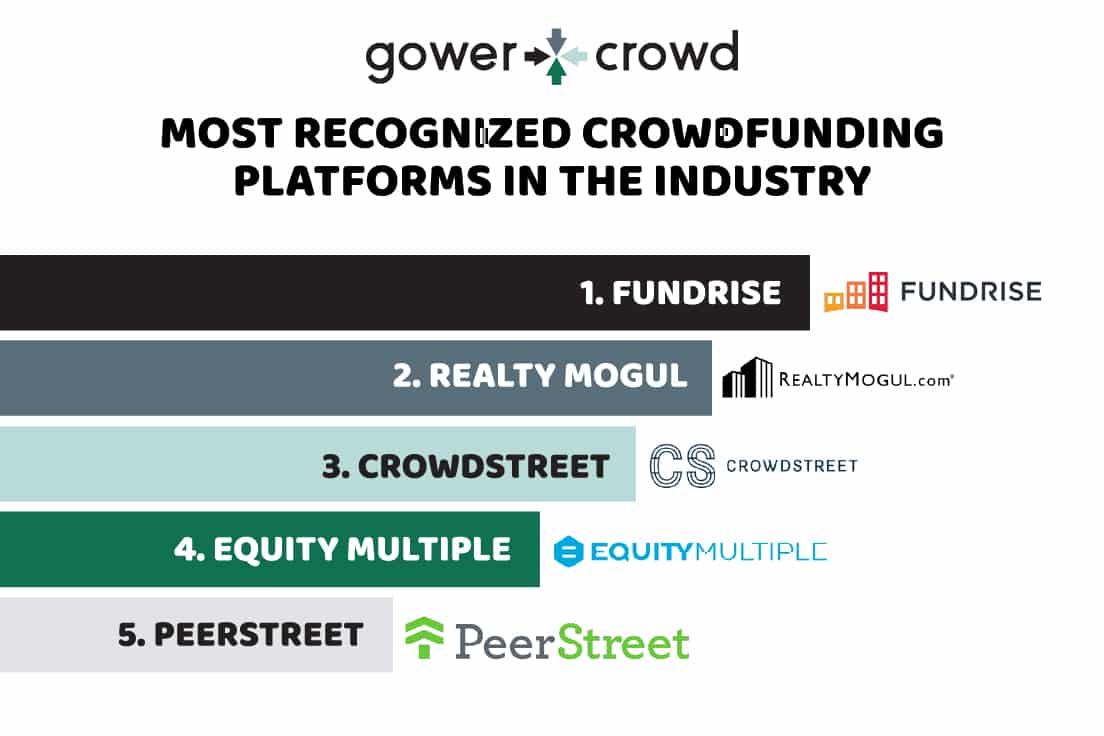

To identify the best of the best platforms, we have conducted exhaustive analysis, not directly of the sites themselves, but of the all the reviews we could find online - a Review of the Reviews.

This is the most comprehensive overview of the top platforms in the real estate crowdfunding world because it consolidates all the available information online and so offers the only crowdsourced overview available of the top real estate crowdfunding platforms.

Below is a list of the top ten sites based on our analysis, as well the results of our research. Please note that this research was conducted prior to Covid and so we expect to update the results in due course.

RealtyMogul

RealtyMogul was one of the first real estate crowdfunding platforms to emerge and has developed a well-established track record. Today, the platform has more than 185,000 registered members and it has raised more than $400 million for commercial real estate deals. RealtyMogul offers opportunities to invest in equity for both private real estate deals as well as real estate investment trusts (REITs). The minimum investment is $5,000.

Fundrise

Fundrise allows people to invest in either eREITs or eFunds, both of which are proprietary (private) investment opportunities unique to Fundrise. The platform allows individuals to invest in commercial real estate deals with as little as $500 initially, with $100 follow-on investments thereafter. Investors select their investment objective, such as long-term growth or balanced diversification, and then are given different options (or funds) to invest in. Funds are then invested in different product types, such as apartments, hotels, shopping centers and office buildings across the country.

One drawback to the Fundrise model, though, is that investors rarely know more than the fund’s investment parameters (e.g., investment strategy, geography and product type); they do not necessarily know how capital will be deployed into specific assets.

CrowdStreet

Crowdstreet is a peer-to-peer marketplace that brings together real estate sponsors and investors interested in buying and selling shares in real estate projects. The platform tends to appeal to more established and sophisticated investors, and as such, has a minimum investment threshold of $10,000 – one of the steepest minimum investments of the crowdfunding platforms featured here today. CrowdStreet provides opportunities to invest in debt, equity and preferred equity alike. CrowdStreet also touts its rigorous selection process, resulting in only 2% of submitted deals making it onto the platform.

STOP PRESS: Latest research shows CrowdStreet to be by far the largest real estate crowdfunding platform.

EquityMultiple

EquityMultiple is a crowdfunding platform that targets professionally-managed commercial real estate. Investments can be made in common equity, preferred equity, and syndicated debt investments. The platform is increasingly featuring qualified opportunity zone investments, as well. Of note, however, is that EquityMultiple is only open to accredited investors. Projects have a minimum $5,000 initial investment, though specific projects require an initial investment of $10,000 or more. The platform allows for investments to be made via a self-directed IRA, but for those investing in this manner, they must be willing to invest $20,000 minimum.

PeerStreet

PeerStreet is an online marketplace that allows individuals to invest in real estate debt. It is one of the nation’s first, and perhaps largest, “two-sided” platforms. In other words, PeerStreet acts as a facilitator between borrowers and lenders. When you invest, you are not investing in deals that PeerStreet is sponsoring, but rather, with third party lenders who are utilizing the PeerStreet platform to sell the loans that they have extended to borrowers. PeerStreet vets all deals before they’re eligible to be featured on its site. Therefore, investors will have transparent information about loan terms, projected returns, yields, LTV ratios and more.

PeerStreet allows investors to participate in loans with flexible terms that provide fixed-income returns. Loans are generally short-term, ranging from 1 to 36 months. The deals are structured so that the loans are in the first-lien position, ensuring investors are first to be repaid with interest payments transferred into the investor's account each month.

At this time, the platform only features residential and multifamily properties. The minimum investment amount is only $1,000 and the platform is only open to accredited investors. One particularly unique feature is that investors can set their preferred investment criteria, and then PeerStreet will automatically allocate uninvested capital into loans that match those preferences, with the ability to “opt-out” of those deals within 24 hours of the investment going live.

PeerStreet first launched in 2014 and has since helped fund more than 8,800 loans totaling more than $4 billion in value.

GROUNDFLOOR

GROUNDFLOOR is an online marketplace that sources real estate debt for short-term (generally 12-18 month) loans. It is one of the first companies to be qualified by the SEC to offer real estate debt investments via Regulation A+ for non-accredited investors. What’s more, people can invest with as little as $10 and can now invest directly through their IRA accounts.

Unlike PeerStreet, GROUNDFLOOR acts as the direct lender. Borrowers can come to GROUNDFLOOR in search of capital for 1-4 unit properties located in one of 10 states (AL, AZ, FL, GA, NC, NV, SC, TX, UT and VA). Most projects are fix-and-flip in nature. The platform touts its lucrative returns, averaging 10% or more for investors, with most investors repaid within 6 to 9 months. The platform has more than 75,000 registered users who have collectively invested more than $250 million in 600+ GROUNDFLOOR-listed investments.

Patch of Land

Patch of Land is a debt crowdfunding platform. Investors contribute to an offering, and once funds are raised, the money is used to make loans on commercial real estate deals. The structure of these deals can vary, but they tend to be short-term construction and mezzanine loans that promise yields as high as 10% to 18%. Returns are high given the inherent risk associated with some of these deals, as “safer” projects would typically just utilize lower-cost bank financing.

RealCrowd

RealCrowd is a crowdfunding platform for accredited investors seeking to invest in commercial real estate assets and funds. RealCrowd acts as the middleman between sponsors and investors. It earns its revenue based on the fees charged to the sponsors (investors pay no fees).

The number of deals on RealCrowd tends to be less than some of the other platforms, but the deals featured on RealCrowd tend to be very high caliber. The company does a rigorous vetting of sponsors in advance, requiring a minimum 10 years of principal operating experience and $50 million of verified transaction experience. In turn, investors are expected to invest a minimum of $25,000 in any deal. People invest directly with the deal sponsor, not with RealCrowd, which instead serves as the facilitator of the transaction.

Rich Uncles

Rich Uncles is one of the more unique crowdfunding platforms. It allows people to buy shares in one of two public, non-traded REITs: its Rich Uncles National REIT, a single-tenant commercial property REIT (which tend to be office, industrial and occasionally retail properties), or its Rich Uncles Student Housing REIT. Rich Uncles purchases the properties with at least a 50% cash down payment. Those who own shares of the REIT will then earn dividends as the company collects and distributes the properties’ rent payments.

Investing with Rich Uncles is particularly attractive to those looking to preserve liquidity. The company offers a share redemption program that gives investors the option of selling their shares back to Rich Uncles. Otherwise, the investment into a Rich Uncles REIT fund is generally a 4- to 7-year commitment, at which time a fund liquidation event takes place and investment proceeds are distributed. Investors should know, however, that Rich Uncles is an open-ended fund, with no pre-set liquidation date. Therefore, Rich Uncles has the sole discretion of when to liquidate its portfolio.

The Rich Uncles BRIX REIT, one focused on student-housing properties, a 24 Hour Fitness, and properties leased by Starbucks, was hit particularly hard by the COVID-19 crisis and as of May 2020, was facing insolvency. If this were to happen, investors in this fund could be entirely wiped out.

Roofstock

RoofStock is an online marketplace for buyers and sellers of single-family rental properties. The platform provides deals of all kinds, ranging from whole or fractional ownership shares of single properties or fully managed single-family rental portfolios. The diversity of offerings allows investors to build and scale their SFR portfolios. One key feature of RoofStock-listed properties is that they’re all in turn-key condition and either already leased or ready to be rented upon close, within 30 days according to RoofStock’s unique industry guarantee.

Buying SFR investment property on RoofStock is easy. Investors start by getting pre-approved by their own lender. Then, they can browse RoofStock offerings that fall within their budget. Investors will then make an offer to purchase a property, with the sellers having 48 hours to accept, decline or counter-offer. Investors can also “buy it now” if looking to purchase a property for its advertised asking price. RoofStock helps facilitate the deal from end-to-end, including property inspections and all deal paperwork through to closing.

RoofStock is a wildly popular platform, in part because it is open to accredited and non-accredited investors alike. In less than four years, the platform has facilitated more than $2 billion transactions.

Requirements for Investors

As noted above, the 2012 JOBS Act allowed online real estate crowdfunding to occur among accredited, non-accredited, and institutional investors, although it wasn’t until 2016 that the SEC promulgated the regulations that allowed non-accredited investors to participate in real estate crowdfunding, as well. Some marketplaces are open to the general public whereas others are still only open to accredited investors and similarly with sponsors who are marketing their own projects, some include non-accredited investors though the vast majority focus on the accredited investor community.

This is an important distinction to make before analyzing opportunities only to learn that you are not an eligible investor. In order to qualify as an accredited investor, a person must have an annual income of more than $200,000 (or $300,000 in combination with a spouse) over the past two years and a reasonable chance of the same in the current year or a net worth of more than $1 million, excluding the value of their primary residence.

How Crowdfunding Can Affect Taxes

One reason why people opt to invest in commercial real estate is for the substantial tax benefits. Those who cannot own commercial property outright can still take advantage of these benefits via online crowdfunding. Real estate crowdfunding allows investors to benefit from certain tax breaks, such as depreciation, that normally only apply to owning property directly. Investing in deals located in qualified opportunity zones may offer additional tax incentives.

Keep in mind that the tax implications will ultimately depend on the nature and structure of the deal, primarily whether it is a debt or equity transaction and the holding period, as properties held for less than a year may be subject to short-term capital gains tax.

And, as with everything on this website, remember the golden rule when it comes to anything to do with tax or law or investment advice – AAA which stands for Ask An Accountant or Ask An Attorney or Ask An Advisor.

Is Crowdfunding Right for You?

There is no right or wrong answer to this question. Determining whether crowdfunding is right for you depends largely on your individual investment goals, your existing portfolio, your risk profile, and how much capital you have on hand to invest. Those looking to gain exposure to commercial real estate, but who have limited capital to invest, may find that real estate crowdfunding is an excellent way to diversify their portfolios. Individuals are advised to discuss with their financial advisor before making any substantial investment – in real estate crowdfunding or otherwise.

If you do decide that you do want to invest in real estate by crowdfunding, then check out this book Leaders of the Crowd and gain more knowledge about crowdfunding. Also, you can sign up for a newsletter and keep yourself updated. We wish you well in your journey of crowdfunding.

Related: 6 Keys to Crowdfunding Real Estate

FOR REAL ESTATE DEVELOPERS

THE WHITE BOARD WORKSHOP

Learn the exact system best of class sponsors use to raise money online.

RELATED ARTICLES

Unwrapping Assumptions in Real Estate Analysis

Last Updated on January 13, 2023 by Dr. Adam Gower FREE TRAINING What is Real Estate Crowdfunding? Learn how to build wealth and earn passive income in real estate while someone else does all the work. Learn More Unwrapping Assumptions in Real Estate Analysis By Adam Gower Ph.D. The Promise of High Returns It…

READ MORE >Sponsor Fees and the Motivating Factor in Real Estate Investing

Last Updated on January 13, 2023 by Dr. Adam Gower FREE TRAINING What is Real Estate Crowdfunding? Learn how to build wealth and earn passive income in real estate while someone else does all the work. Learn More Sponsor Fees and the Motivating Factor in Real Estate Investing By Adam Gower Ph.D. When looking at…

READ MORE >Copyright 2018 - ADAM GOWER PH.D. - All Rights Reserved