A Primer on How to Utilize Opportunity Zones

By Adam Gower Ph.D.

When the Tax Cuts and Jobs Act of 2017 was passed, while the bill itself was a partisan one, there was also a concept with bipartisan origins that came along with it: Opportunity Zones.

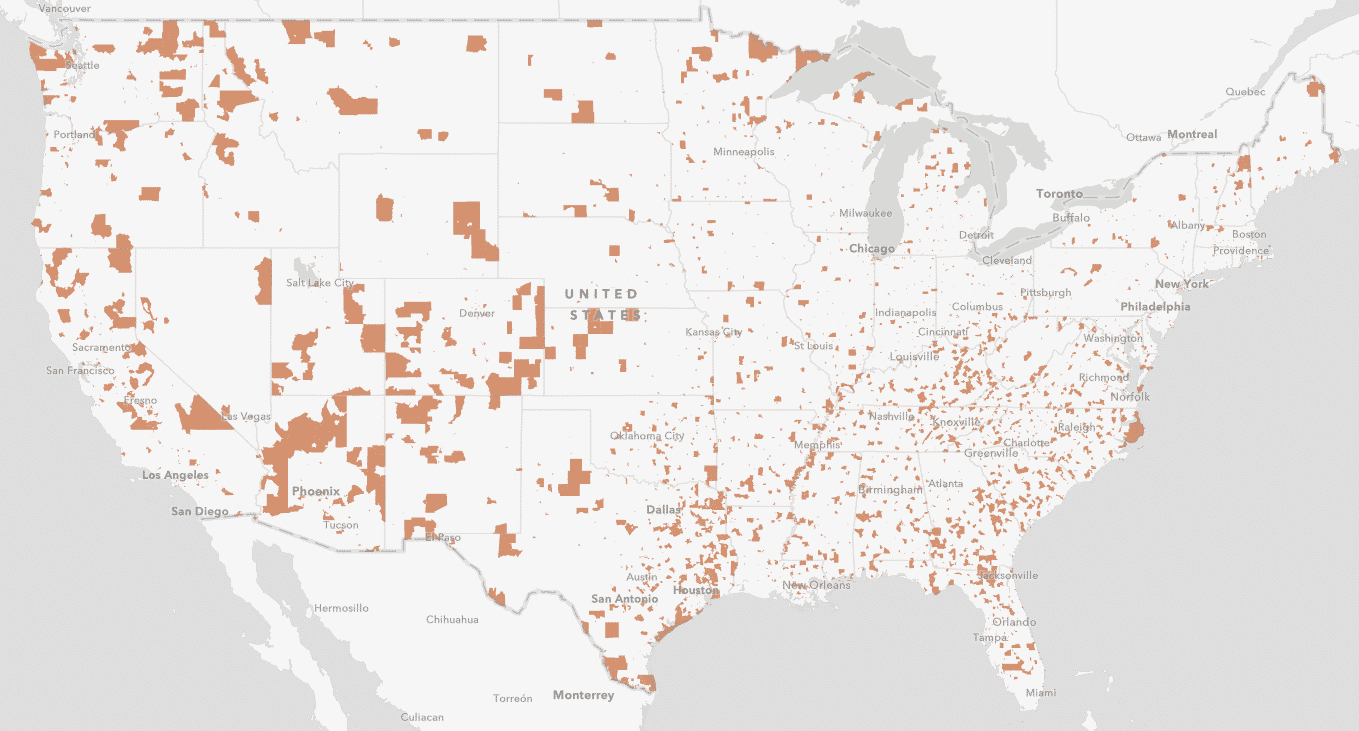

The idea is to stimulate inward investment in both businesses and real estate in specifically designated areas around the country that are considered economically distressed.

To create this investment impetus, the Act provided for a combination of significant tax deference and tax-avoidance from gains enjoyed by sale of real estate or stocks or art or any other capital gain, provided those gains were reinvested in companies or real estate located in Opportunity Zones, or “OZs."

This has presented investors with one of the greatest real estate investment opportunities (hard as it is to avoid this pun) to have emerged since the 2012 JOBS Act which allowed sponsors to advertise to investors with whom they had no prior relationship - a relic of the 1933 Securities Act.

The combination of the 2012 Act permitting general solicitation, and the 2017 Act providing substantial tax breaks rewarding investment, has created an alignment of forces that have made OZs among the most popular real estate class to have emerged in decades.

Indeed they have drawn the attention of of foreign as well as domestic capital, further compounding the impact of the Act on liquidity.

However, because both the program and the concept are in their infancy, there are a lot of interested individuals and companies still holding misconceptions about opportunity zones.

Here are some insights on how they work and how you can begin taking advantage of them.

What Are Opportunity Zones Really?

Opportunity zones mark the first new federal community-development program using tax incentives since the Clinton administration.

At the core, the program offers significant tax benefits if capital gains are reinvested into economically distressed areas.

What qualifies as “economically distressed” were determined by state governors, but here are some of the provisions:

- A census tract had to have a poverty rate of 20% or more.

- Median incomes could not exceed 80% of the metro or state level.

- The designation will remain in effect until 2028.

- 5% of designated census tracts could be adjacent to areas that meet these criteria, even if they don’t meet them.

In order to take advantage of the tax benefits, investors need to put their money into a special investment vehicle called an Opportunity Fund.

These must place at least 90% of their assets into opportunity zones.

Funds can invest in businesses as well, but such enterprises need to earn at least 50% of their income from the active conduct of business in an opportunity zone.

The primary benefit of the zones is that taxes due on capital gains can be deferred until the end of 2026.

If capital were invested for at least 5 years in an OZ, the otherwise taxable amount decreases by 10%.

At 7 years, there’s another 5% decrease, and after 10 years, the gains become tax free.

Note that in order to reap these benefits, capital needs to be placed into an Opportunity Fund within 180 days of the gain – so they function in this regard similarly to 1031 exchanges, only with a longer re-investment window.

What makes these funds particularly exciting for investors is that all capital gains, no matter how or upon what incurred, and both long and short term capital gains, can be deferred through investing in an OZ.

As noted, while there is a graduated scale during which tax forgiveness is increased, capital can be allowed to grow tax free and if held for ten years can be withdrawn through sale without incurring any capital gain liability.

FREE Real estate syndication education and insight newsletter. Subscribe now.

The Impact of Opportunity Zones

As it is still early in terms of the program it's difficult to talk about the impact of opportunity zones without being anecdotal and while there is a lot of positive talk about opportunity zones, and a great deal of capital being raised for them, as yet, not so many transactions are being consummated as you may think.

That said, there are many deals that are close to transacting, so we may get a better picture of opportunity zones and how they play into market dynamics soon.

In addition, while there are a lot of interest in equity raises from independent fund managers, it looks like family offices are the entities getting the earliest starts.

This is probably due to their ready access to capital as well as the fact that it’s easier for them to move quickly.

One thing that can’t be ignored when it comes to opportunity zones is how they are going to impact pricing moving forward.

Prices in underserved areas of some opportunity zones are already seeing increases between 5 and 10% but this is not widespread and it is more likely that the bulk of opportunity zone capital will go into areas that are already gentrifying or have some sort of strategic value.

Issues With Opportunity Zones

While opportunity zones have the potential to be advantageous for developers and investors, with tenants having the chance to benefit as well, there are still a few outstanding issues with the program that the Treasury will hopefully be able to address in the near future.

For example, there is currently a major challenge for funds looking to purchase and manage multiple assets in a single fund, as opposed to a single project and exiting a fund that holds multiple assets is still thought to harbor specific tax roadblocks.

Another outstanding problem that needs to be addressed is how existing real estate owners will be able to participate, specifically, those who held assets in opportunity zones before the concept was enacted.

Clarifying these issues remain high on the Treasury’s radar.

How Taxpayers Can Use The Benefits

There are three main elements for taxpayers to consider in order to be eligible for the benefits of opportunity zones.

1. The primary benefit is a reduction or elimination of capital gains tax obligations, long and short, no matter how accrued.

2. These gains must be reinvested in Opportunity Funds within the 180-day window from time of sale, without being compelled to reinvest all gains from an individual transaction.

3. In electing to defer gains taxpayers must file Form 8949 to let government the program is being used.

There are a variety of different resources out there that can show you where the opportunity zones are in your area, if you’re interested in participating in the program.

See below for some of those additional resources.

Right now, there is a broad interest in a variety of different property types for these areas, but what is best will ultimately depend on the specific area.

Opportunity Zone Challenges

All that said, the single most important driving principle for investing in an opportunity zone, as it is for any real estate investment, is that the transaction itself must make sense.

There is little point investing in a tax break if the investment itself is a dud.

Three factors present significant challenges for investors seeking to benefit from the tax breaks offered through opportunity zones.

One is that, by their very nature, OZs are, for the most part, areas that are considered distressed by their states and consequently lacking in 'natural' attraction for real estate investors.

This will mean that finding viable deals will pose challenges for sponsors though being able to build tax benefits into proforma projections should provide an enhanced competitive edge against non-OZ opportunities.

The second challenge facing OZs is the sheer competition to acquire and develop viable sites will have a strong inflationary effect on pricing and a consequent dulling effect on the very viability that make them attractive in the first place.

And the third factor to keep in mind is that as the rules are so new, they have yet to be tested and so prudent investors may wish to wait until Treasury Department guidelines are made clearer.

RELATED ARTICLES

7 Ways You Can Invest in Commercial Real Estate Online

Last Updated on December 16, 2023 by Dr. Adam Gower FREE TRAINING What is Real Estate Crowdfunding? Learn how to build wealth and earn passive income in real estate while someone else does all the work. Learn More 7 Ways You Can Invest in Commercial Real Estate Online According to the research site, Statista, commercial real…

READ MORE >Real Estate Investing Explained – Impact Investing

Last Updated on May 24, 2022 by Dr. Adam Gower FREE TRAINING What is Real Estate Crowdfunding? Learn how to build wealth and earn passive income in real estate while someone else does all the work. Learn More With Support from SmallChange You’ve heard of ‘Impact Investing’ in the business world; investing in socially conscious…

READ MORE >Understanding Institutional Real Estate

Last Updated on December 16, 2023 by Dr. Adam Gower FREE TRAINING What is Real Estate Crowdfunding? Learn how to build wealth and earn passive income in real estate while someone else does all the work. Learn More Understanding Institutional Real Estate This article is based on a conversation I had with Mike Hu, Managing…

READ MORE >Newbie

If you want to build your wealth and earn passive income from real estate investing and are looking at deals on marketplace platforms or through developers online, then I recommend you start by the 8 Key Financial terms so you can understand every deal you look at.

The 8 Financial Keys are not only a great way to get started, they are also essential to understanding how you’ll make money in any real estate deal.

You’ll learn the most important financial concepts you need to know in real estate investing that apply to every type of real estate no matter the asset class (office, industrial, residential, hospitality, retail).

Intermediate Investor

If you’ve got some online real estate investments under your belt already and are beginning to receive passive income checks each month, or have been paid off with profit – or (hopefully not) are finding that some deals are not quite panning out the way you expected, then check out this page for a wealth of free resources.

Here I cover everything from beginner all the way to very advanced real estate concepts.

You’ll find podcasts with developers, researchers, professors and other industry experts, detailed articles, and lots of videos, both short and long that are all easily searchable and totally free.

Advanced Investors

I am not shy about being straightforward about real estate investing; it is exciting, lucrative, and can help you build wealth and income as part of your investment portfolio, but it is not without its risks.

As an advanced investor you know this already, so I’ve put together a webinar for you that guides you through one of the most important components of real estate investing: Real Estate Contracts – reading between the lines.

This is advanced learning and based off conversations I had with three of the top real estate attorneys in the country, combined with my own personal experience. Access it here; it could be the most important webcast you watch all year.