How to Recognize a Housing Bubble

By Adam Gower Ph.D.

Past performance is not a guarantee for future results.

This boilerplate disclaimer is standard wording for just about any financial investment we might make, but when it comes to buying a home it is often disregarded.

Home-buyers tend to be driven by the idea that because prices went up last year, they must go up again next year.

Same goes for speculators, who, seeing a steady upward trajectory in house prices, assume that this is also a guarantee of future increases in value.

To be sure, there are some fundamental factors that drive price increases, but without being specific about what caused last year's price rises, how can the buyer be so sure that prices will go up next year, also, or the year after, or the year after that, or, indeed, that prices won't go down?

Predictability and Volatility

Usually in finance, we like to think that the prices of assets like a stock, or like a house shouldn't be predictable, because, if people could predict where prices were going to go you could make a lot of money by investing in the market in the right way.

And yet there is some truth to the predictability of house prices.

On the other hand, house prices can also be very volatile.

We saw this in the 2007-2008 financial crisis - the large boom and bust in house prices in the US.

Indeed, there typically are very large cycles in housing markets, where prices are moving a lot more than underlying measures of the desirability to live in certain areas, like rents, or local incomes.

Understanding the forces that are responsible for these sorts of patterns in house prices requires thinking about the way that participants in the market form their beliefs about where prices are going to go in the future.

There are two possible reasons for rising prices.

One would be that the underlying fundamentals have improved.

These might include the desirability to live in the area; productivity of the industries that may be located there, improved amenities, reducing crime rates, etc.

If these fundamental factors have improved and made it more desirable to live in the area, that could be what's pushing up prices.

However, the other possibility is that people's beliefs of how much prices will rise have increased and that the change in these beliefs have pushed up prices.

It's just the fact that other people are getting more optimistic about prices, and that, in itself, is pushing up prices.

The problem is how a buyer should react to recent price increases in an area depends a lot on which of these two possibilities is actually going on.

If you think that the prices are going up because the region is getting nicer to live in, then maybe you think that the region will continue to get nicer to live in.

You'd like to buy today and push up prices a little more by paying more, because you think that the fundamental factors that have been pushing up prices will continue to improve, so you want to keep bidding up prices.

If prices went up just because other people believed they would and paid more as a consequence – self-fulfilling their own prophecy – then a prudent buyer won’t want to push up prices further because the region hasn't actually fundamentally improved in any way.

FREE Real estate syndication education and insight newsletter. Subscribe now.

How to Recognize a Bubble

Bubbles occur because the process becomes amplified where initial price increases gave people optimism about future increases and caused them to push up prices.

Then, as they push up prices, other buyers get even more optimistic, and that further pushes up prices, and prices start growing exponentially.

Once this takes over and as market prices continue to increase, people start to predict that will continue and short-term buyers are drawn into the market which further accelerates price inflation.

If you are a long-term buyer, planning to settle in a house for decades, then you don't actually care so much about predicting the future path of house prices, because you're just going to buy it, and hold it for so long, you will have discounted that future very much, informing your initial plan of how much you want to pay for a house.

Whereas, if you have someone who's buying, and planning to sell in a year or two, that person cares a lot about where prices are going to go.

Indeed, short-term buyers, so called fix-and-flippers, must assume that because prices went up last year, prices are going to rise again next year; it is a core thesis that drives their business model.

When both long and short term buyers are in the market, and as prices start to rise, the short-term people will actually crowd out the long-term people and will become the dominant factor in the market.

The challenge for any buyer, therefore, is in assessing a local market and understanding what is driving price increases.

A prudent buyer must differentiate whether house price increases are a result of local speculative activity, or as a result of fundamental improvements, and increased demand in the area by people similar to themselves.

One useful metric is to look at how many of the current buyers are just selling after a short amount of time, versus how many of the current buyers are in it for the long run.

Sales Volume as Indicator

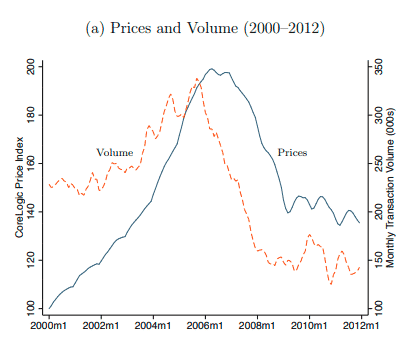

The really striking fact is that transaction volume will often decline noticeably before prices and so serves a good indicator that a bubble has burst.

Although both volume and price go up together, transaction volume, which is just the number of units sold, starts to decline well before prices.

What happens is that when prices are rising, as previously mentioned, a lot of short-term buyers are drawn into the market.

That increases transaction volume because they're going to sell a lot more quickly than the average buyer, so you get a lot of sales where volume and prices are both going up.

Eventually, however, price growth starts to slow down.

Prices are still rising, but they're kind of getting near their peak.

As price growth slows, people begin to expect less price increase going forward and start to think the market is stabilizing; they become less optimistic.

Now, fewer short-term buyers are getting so excited about buying and flipping houses as they used to, because now they don't expect prices to keep going up as fast as before.

When this happens, there are a lot of short-term buyers who are trying to sell the houses they bought maybe a year or two ago, but they can't find anyone to sell to, or they can't find as many people as they would like to sell to, because now that price growth is slowing, fewer new short-term buyers want to come into the market and buy.

Prices continue to rise but there is a decline in the actual number of transactions in the market.

This period where prices are rising, but starting to level off, and transaction volume is falling is called 'The Quiet,' because people get a sense that the market is a little less excited than before.

People expect less price growth; transactions are declining, and a lot of unsold inventory is starting to accumulate on the market, as the previous short-term buyers can't sell.

It is then the bubble bursts, pricing starts to tumble, and the market goes into a recessionary period. You can see how this works in the chart below:

Source: https://mendoza.nd.edu/wp-content/uploads/2019/01/2016_fall_seminar_series_charles_nathanson_paper.pdf

The chart clearly shows that 'Wile E. Coyote' moment when prices continue to rise even after the bottom has dropped out of the market. Sales volume drops precipitously, but buyers keep paying up unaware that there nothing remains to hold up pricing.

Conclusion

In order to understand what is going on with recent house price increases, we need to know what prior buyers believed when they bought their houses.

If they bought under the assumption that prices were going to rise, then their decision may have been irrational, and so, possibly, pushed up prices disproportionately to market fundamentals.

One way to measure this is to assess what proportion of those increases were driven by speculators.

If there is a preponderance of such activity, this might be indicative of being in the later stages of a cycle.

Transactional volume alone can be a precursor to where pricing is likely to go.

If one sees a tailing off of volume, it may be the first sign that prices are also about to stop rising and may be on the way down.

Copyright 2018 - ADAM GOWER PH.D. - All Rights Reserved