FREE TRAINING

What is Real Estate Crowdfunding?

Learn how to build wealth and earn passive income in real estate while someone else does all the work.

A Starter Guide on Preferred Equity

Preferred equity is one of those financial concepts that a lot of investors believe they understand, and yet each may have a different concept in mind which can lead to confusion and misunderstanding.

This article provides guidance on the definition of preferred equity, and how you can tell the difference between the different types.

Define Preferred Equity

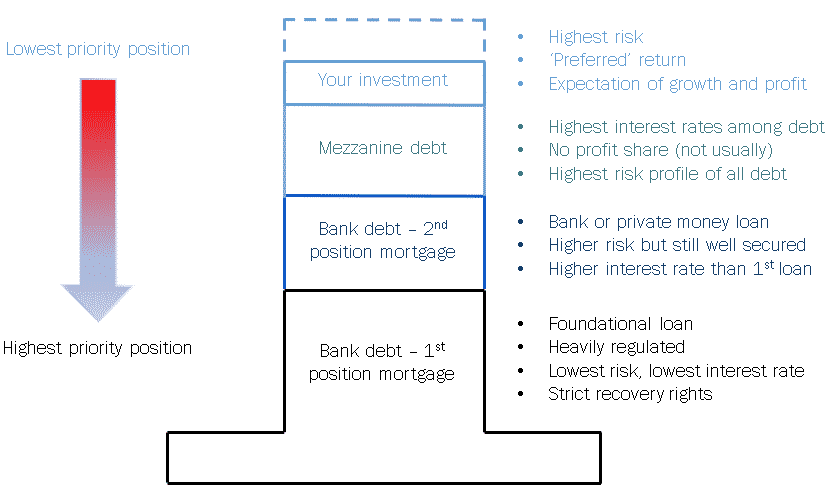

In commercial real estate, preferred equity functions much like preferred stock does in the corporate world. In what’s known as the “capital stack,” preferred equity is subordinate to all forms of debt but holds a place superior to common equity. Once lenders are repaid, owners of preferred equity begin to receive their dividends and related payments.

Preferred equity is typically utilized when a sponsor needs to close a financing gap and/or when the sponsor wants to reduce their leverage and increase their own liquidity.

Preferred equity costs more than common equity, but the upside is that investors usually benefit from higher returns that pay out sooner than common equity. As a result, if a real estate deal underperforms, preferred equity holders bear less risk than those who own common equity.

Types of Preferred Equity

Simply stated, there are two types of capital that are used in any real estate transaction; debt and equity.

The main difference between these two types of capital is that debt will only be repaid with interest, whereas equity is commonly paid a type of interest (usually called a ‘preferred return’), plus, importantly, a share of the profits.

Each of these categories of finance can be broken down into different subcategories.

For example, there are different kinds of debt; senior debt, most often provided by banks, second-position debt which is subordinate to senior debt, and even third and fourth position debt, and so on, each subordinate to each other sequentially.

All types of debt are considered loans to the property and are typically secured by recorded liens on the property.

Liens against the underlying real property are put in place so that should the borrower stop paying as agreed to any lender there is a formal record of the obligation.

Using the foreclosure process, lenders can institute recovery efforts potentially culminating in their taking possession of a property away from a borrower.

Related: Preferred Equity or Mezzanine Debt: What's Right for You?

Mezzanine Debt

Mezzanine debt financing comes last after other types of debt, is always subordinate to any other recorded debt, but is ahead of all equity.

However, mezzanine debt does not record a lien against the property itself as collateral.

Instead mezzanine debt secures its position with a claim against the equity in the deal via a UCC financing statement filed against the partnership interest.

Despite not securing its position against an interest in the underlying real property, mezzanine financing is considered a loan to the project and mezzanine holders are considered to be lenders which affords them different recovery rights than equity holders.

The Capital Stack

At the bottom of the stack (see illustration above) the most stable of all the capital; the foundational capital upon which all other funding is placed, is the bank debt, with a 1st position mortgage, also known as senior debt.

On top of that might by another layer of debt, the second position debt.

Then follows the mezzanine debt, then the equity which might be split between preferred and common equity.

Generally, second position debt will earn an interest rate higher than that in first position because it bears higher risk.

Mezzanine debt is so called because it sits in between two different types of capital and is the last layer of financing before the equity layer in the capital stack.

Preferred Equity

During the financial crisis of 2008-2009 banks discovered challenges foreclosing on properties that had a layer of mezzanine debt on them.

Mezzanine holders acting in their capacity as lenders to projects, were able to exercise outsized influence on the control of the real property and therefore banks now include in their loan documents prohibitions against adding extra layers of debt, including mezzanine debt, on top of the senior position.

To fill the gap that the absence of mezzanine debt left, preferred equity is increasingly used in its place. Like mezzanine debt, preferred equity is subordinate to all debt, and superior to common equity.

Preferred equity does not receive a share of the profits of the transaction and yet, as its name suggests, preferred equity is not debt and investors in preferred equity are not treated like lenders.

But if preferred equity investors are not considered lenders to the project – a key contrast to mezzanine debt - and yet don't share in the profits, as typical equity investors might expect, what are they?

Get access to our FREE weekly newsletter exclusively covering the latest updates from the real estate crowdfunding world

The mechanism by which investors can secure their interests that differentiates preferred equity from mezzanine debt is as follows:

Preferred equity holders, as members of the LLC controlling the real estate, can in the event of default take over control of the LLC.

In the case of preferred equity, recourse is strictly a function of the structure of the operating entity and the relationship between the various parties.

And because preferred equity holders are simply a different class of shareholder in the company that is operating the real estate project, they do not represent another layer of secured debt and consequently pose reduced compliance issues with lenders.

Mezzanine debt holders are not members of the LLC, but their recourse is to take possession of the LLC in its entirety in the event of default, through a UCC foreclosure.

This contrasts with a debt lender with a lien against the property who would take over ownership of the real property itself - preferred equity and mezzanine debt investors take over ownership of the partnership that owns the property.

While the intent of preferred equity is to fill whatever the gap was left by mezzanine debt, there is a broad array of different rights and remedies that can be built into an operating agreement.

Consequently, sophisticated investors should take into consideration what these rights and remedies are when comparing different preferred equity investments – no two ‘preferred equity’ structures are the same and, in fact, can be very different.

Which Type of Debt is Most Often Secured?

Most sponsors will typically utilize traditional financing whenever it is available. Traditional debt, which includes investments made by banks, life insurance companies, pension funds and other institutional investors, is usually offered at the lowest cost and therefore, a sponsor’s first choice when looking to secure debt.

Most real estate transactions will be financed with about 60% traditional debt. Depending on the structure of the deal, the sponsor may then seek additional debt, such as mezzanine debt. Mezzanine debt might be used for the next 10-20% of financing (sometimes more, sometimes less). This leaves roughly 20-30% of the investment to be financed by the sponsor and its equity investors – including preferred equity and common equity shareholders.

Related: Interesting Facts You Didn’t Know About Real Estate Crowdfunding

Soft v. Hard Pay

One way in which preferred equity positions can be very different from each other is the manner in which they are paid; soft or hard.

Hard pay functions more like a debt-instrument where if there's a non-payment there are some punitive remedies.

The operating agreement will say that the operating entity has to make a certain payment on the first of every month, and pay off the entire loan within a certain period of time, let’s say 3 years.

If the entity, controlled by the sponsor, doesn’t make any of those payments, pure ‘hard pay’ remedies that could be enforced could include wiping out all the subordinate equity, and taking over control of the partnership interest.

In this sense it is pretty much identical to mezzanine debt.

And it is precisely for this reason that banks don’t like hard pay preferred equity positions.

The bank is lending to the sponsor and does not like subordinate positions to have the right to take over the operating entity they are lending to.

Soft pay terms, more acceptable to lenders, just require the sponsor, or the operating entity, to make payments when there is sufficient cash-flow to be able to make payments and if there is a failure to pay, there may or may not be remedies the preferred equity holders can employ.

Furthermore, while preferred equity is paid before common equity, there may be ‘hard pay’ terms that set aside a preferred interest reserve.

The preferred equity holders will be paid out of this reserve, even though common equity holders may receive first distributions of income from cash flow.

Risks to Unsophisticated Investors

This combination of different interests and options can create additional risks for unsophisticated investors.

If a sponsor puts together a deal that works in their best interests, like a soft-pay preferred equity deal, they may be able to put this in front of a crowd that doesn’t understand whether the deal is good or bad.

In essence, it could allow the sponsor to have a free option with the preferred equity money.

Consequently, there are vast differences between types of preferred equity.

Investors should be keenly aware that their rights can be materially affected in one kind of preferred equity versus another and should be conscious of what their rights are before making an investment.

Get access to our FREE weekly newsletter exclusively covering the latest updates from the real estate crowdfunding world

Why Invest in Preferred Equity Real Estate

There are several reasons why people choose to invest in preferred equity. First, it’s a way of investing in real estate without taking on the responsibility of direct ownership. Second, it allows investors to be repaid sooner than common equity shareholders, and therefore, shoulder less risk in the event that a deal goes sideways.

As soon as the debt providers are repaid, preferred equity investors collect their share of the project profits until they meet a pre-determined threshold—ahead of common shareholders earning their dividends.

Finally, in today’s real estate climate in which prices have continued to climb, it’s not uncommon for preferred equity to earn double-digit returns. This makes preferred equity a highly attractive opportunity for investors looking to get into commercial real estate who have exhausted other means of entry.

Learn With GowerCrowd

Investing in preferred equity or mezzanine debt is a more sophisticated approach to real estate investing. To learn more about how GowerCrowd can help you make better informed decisions please take a look at the resources below.

Newbie

If you want to build your wealth and earn passive income from real estate investing and are looking at deals on marketplace platforms or through developers online, then I recommend you start by the 8 Key Financial terms so you can understand every deal you look at.

The 8 Financial Keys are not only a great way to get started, they are also essential to understanding how you’ll make money in any real estate deal.

You’ll learn the most important financial concepts you need to know in real estate investing that apply to every type of real estate no matter the asset class (office, industrial, residential, hospitality, retail).

Intermediate Investor

If you’ve got some online real estate investments under your belt already and are beginning to receive passive income checks each month, or have been paid off with profit – or (hopefully not) are finding that some deals are not quite panning out the way you expected, then check out this page for a wealth of free resources.

Here I cover everything from beginner all the way to very advanced real estate concepts.

You’ll find podcasts with developers, researchers, professors and other industry experts, detailed articles, and lots of videos, both short and long that are all easily searchable and totally free.

Advanced Investors

I am not shy about being straightforward about real estate investing; it is exciting, lucrative, and can help you build wealth and income as part of your investment portfolio, but it is not without its risks.

As an advanced investor you know this already, so I’ve put together a webinar for you that guides you through one of the most important components of real estate investing: Real Estate Contracts – reading between the lines.

This is advanced learning and based off conversations I had with three of the top real estate attorneys in the country, combined with my own personal experience. Access it here; it could be the most important webcast you watch all year.