218 Tore Steen, CEO and Co-Founder, CrowdStreet

Looking to the Future

Having been founded only in 2013, CrowdStreet’s growth trajectory has been very rapid reaching the $200 million milestone of equity placed just four years later in 2017 and exceeding 70,000 investors in the same year. The company focuses on bringing institutional quality deals with a diversity of both asset types as well as risk profile so that investors can create a truly diversified portfolio of commercial real estate. The platform plans to incorporate easy to use tools to compare and contrast the offerings in a transparent for way for member investors who have multiple investments on the marketplace to be able to view their portfolio in a very constructive manner.

Though impossible to predict, the company attempts to remain cognizant of the inevitability of a real estate market recession and how to address investor anxiety understanding that no-one wants to be the last one in on a deal, so to speak. Being conscious of leverage rates that developers are using and where are soft places in certain markets, CrowdStreet tries to give a little bit more clarity of what the outlook looks like at any point in time, from an overall economic as well as from a real estate perspective.

Real Estate Meets Tech

Tores’s background is squarely in the Internet and software space for the last 20 years of his career and in bringing technology into industries that have not adopted the Internet and software for the betterment of their customers as well as the operating efficiencies. He also has a background in financial services, though he does not like to confess to this, and early in his career started in banking. This gave him a good appreciation for lending and for the financial institutions and the financial services and consumers. It served him well when he met Darren Powderly his co-founder at CrowdStreet some years later. Darren comes out of the commercial real estate space and was a partner at a well-known firm in the Pacific Northwest. He was looking for a co-founder who had built Internet and software based businesses before in order to facilitate his vision for a marriage between technology and an industry that traditionally has not adopted technology to really transform real estate investing.

Leaders of The Crowd

Conversations with Crowdfunding Visionaries and How Real Estate Stole the Show

Discover how laws that gave us crowdfunding were solely meant to finance small companies and yet inadvertently opened the doors to allow you to invest in real estate like never before.

Read the book and listen to the actual conversations.

Advent of the Online Capital Raise

One of the largest challenges they faced early on, and it is not uncommon when trying to transform and disrupt an industry, was that there is a lot of education needed initially. The legislation and the securities laws had been changed but there were still a lot of questions and ambiguity about it. In the early days of the company, they had to do a lot of evangelizing and a lot of educating of commercial real estate developers, operators, and investment firms who were intrigued by the idea but really had more questions than they had answers. Tore found CrowdStreet was to be part of a subset of a subset people out there sharing knowledge and information, and many times connecting them to other experts whether it was attorneys who worked on the SEC in legislation to enable this to happen, or whether it was some of those early adopters who had taken the plunge and were the innovators. So that was really one of the biggest hurdles which was really getting the industry to understand that this new opportunity was possible; that it was legal and that it would actually benefit their business as well as benefit many consumer investors across the country.

How to Fund Your Deals

7 Steps to Raising Equity Online

Key Benefits

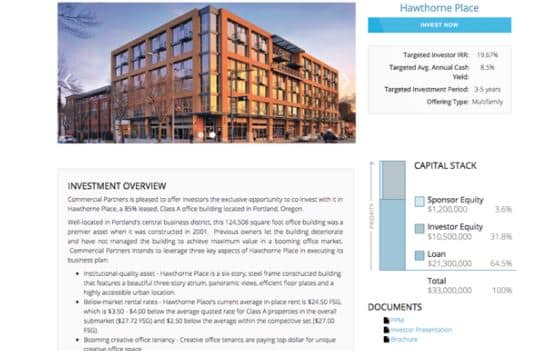

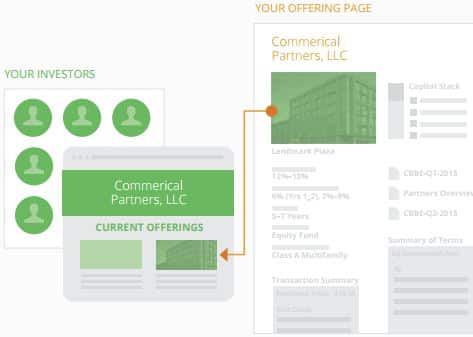

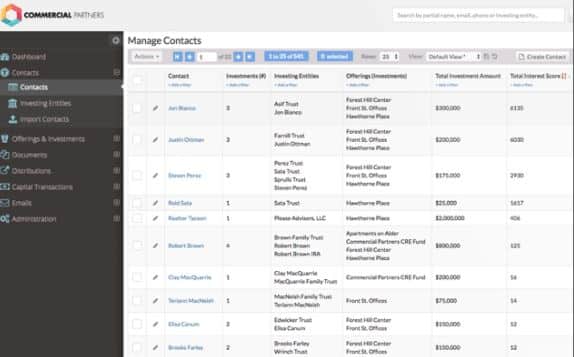

The second key aspect that's tied to that, is not only the acquisition of new investors and the efficiency by which they can do that, but by facilitating the mechanics of investment itself. By automating and streamlining the fundraising process from review of the information entirely at the fingertips of the investor, through the actual investment itself, deciding how much an investor wants to put in, to signing documents and then funding their investment and then post fund raising. Everything is automated on the CrowdStreet platform. In addition to this, another thing that sponsors like is that the ongoing communication with investors is done through an online channel which brings with it many more efficiencies and the capability that now that they have maybe up to 50 more investors that they are working with, they can actually do it in a very efficient manner.

When they log into their investor room investors can see the performance of their investment they can see all of their executed documents and then when the sponsor comes to that wonderful tax season where they are trying to distribute hundreds if not thousands of K1's they can simply drag and drop and the K1's which get uploaded automatically into each individual's investor room. The individual investor will get an email communication, not with an attachment because of security concerns, that if they log into their secure investor room, they have access to a secure K1 document. This minimizes security concerns caused by sending a PDF document over an unsecure channel, and improves communication by sending documents to many with literally one click of a button instead of having to do individual one to one communications.

Alleviating Concerns

Many times when sponsors were raising capital the ‘traditional’ way, they were faced with a lot of email exchanges and a lot of phone calls so they come from a world where investor relationship management could be pretty cumbersomebecause it was usually a manual process. One concern sponsors have is that when they bring their offering online that now they will be fielding calls by vastly more investors and going to have to answer a lot more e-mails. Tore understands this concern from his perspective of having brought industries online to seeing what can happen in those circumstances. The consumer that comes to a site and gets exposed to a brand and a company through an online channel, does not generally want to take that relationship offline. Consumers do not go to Amazon.com to buy a product because they want to call the company and learn more about the product; they want to go review and see everything and read about everything about that product online and be able to make a best educated decision without dealing directly with the company.

Confidentiality and Privacy

Direct Contact

Crowd Sourced Questions

Deal Structure

Since the advent of crowd funding real estate, from a deal structure perspective on the distribution of capital on a current basis, CrowdStreet has not seen sponsors change the structure of their deal to align with online investor requirements for having cash flow. Most sponsors have already come up with their waterfall structure before them come to the platform. They have come up with what their anticipated current yield is on a particular investment and that has not changed much. Maybe sponsors have become more conscientious about the fact that that the online investor with whom they have yet to build a relationship does like a current yield, but investors do understand that certain deals will not have a current cash flow to it – whether it is a ground up development or whether it is a redevelopment. Sponsors are very clear from the onset that it could be maybe an 18 month timeframe or 12 month timeframe until there is any current cash flow from a project. Investors know that maybe on that redevelopment there is no current cash but that there is a higher IRR potential that is maybe over two years instead of over seven years. What CrowdStreet has seen is that investors like to create a diversified real estate portfolio where they can pick and choose from projects that are cash flowing currently versus those that might be more realized on the back end.

Aspects of Education

Another aspect in the education process is to really let investors and consumers across the country understand, number one, why this way of investing was suddenly available for an industry that for decades they could not get access to. Before, investors had to get a personal invitation to meet the sponsor from somebody who had invested with that sponsor, possibly many times. And then, even if they got invited, they didn't want to put in $250,000 dollars, perhaps having $25,000 or $50000 to put to work or wanting to spread it around to many deals. The second big question from investors is often how do sponsors get on the CrowdStreet platform. So Tore and his team are very up front with their investor community about the vetting process that their investments team employs. They have a team of eight people who come out of the private equity real estate space for a real reason; because they are used to screening sponsors and they are used to screening the deals themselves. CrowdStreet does not underwrite the deal, but they do have a detailed process around the vetting so that investors know more about the sponsors. To be clear, CrowdStreet is not doing due diligence per se in the traditional sense but they are very clear about the vetting and the background checks that go on behind the scenes on the sponsors before they actually show up and they have found that investors appreciate that.

Challenges

For Tore, coming from a tech background and migrating into the real estate world also had its own learning curve. Having worked in many different industries and coming at it from a technology perspective, whether it was health care education publishing world he had worked with many different verticals and industries. Figuring out where their biggest frustrations are and what are the biggest obstacles that industry participants are facing was the first step because it is always unique across the industries. Dealing with investor and sponsor adoption of and trepidation with leveraging the Internet there was this early concern that the offline consumer is not going to take online. Initially, Tore took things for granted and had to back up a little bit and understand better about the world that sponsors come from, learning about their pain points on investor relationship management and in the fund raising processes. He also spent time with Darren and with customers understanding more about their world and how CrowdStreet could solve problems for them because at the end of the day the ultimate objective is to help both the investors as well as the sponsors and to do better for both of them.

Employee Investments

The policy at CrowdStreet is that anybody who is qualified can invest in any of the projects on the marketplace. There is no special treatment given because it is the open internet out there, and people can register so the company does not want to say no to an employee – but there is no special treatment given and they make sure that there is nothing extra that they get.

Prefunding Deals

To date, most of the sponsors have not asked CrowdStreet to prefund a deal. The company took a different approach from other platforms some who did go that Special Purpose Vehicle model where investors are pooled into an SPV, usually an LLC., and take balance sheet capital to supplement that fund raising. CrowdStreet took a very much a road less traveled approach. It is also a road that takes longer until there is investor base that has thousands of investors. You cannot stand up straight with a sponsor and say that there is a high degree of confidence of selling the equity portion without that investor base. In many cases, sponsors will explain that they are listing a sliver of the equity because they have their own current base of investors. That said, CrowdStreet did take a pretty significant pivot as a company back in early 2015. They learned from those sponsors that were using the marketplaces that not only did they love the capability to instantly get in front of thousands of investors across the country but they also saw the capability of the technology platform.

Back to the Future

When Darren and Tore got together in 2013, the passion, the vision of democratizing access to commercial real estate investing was baked into their idea of how they could transform real estate investing to make it accessible to make it transparent to make it efficient. Right now they are just scratching the surface and one thing that particularly excites Tore, is the that the market has not opened up yet for the non-accredited investors to participate. This is a stair step thing; it does not happen overnight but one sees a lot more sponsors being receptive to doing a Reg A plus filing, or a Tier II where they can raise up to $50 million and they can do it through a general advertising and they can make it available to non-accredited and accredited investors at the same time. Tore thinks that is one of the one of the phenomena that is going to happen over the next three to five years where people will be able to put in as little as $1,000. You cannot do that without using automation as technology.

Tore also sees another potential major shift in the market. At the end of the day commercial real estate is still an illiquid asset; in many cases there is no current cash flow. You could be in an asset for the next three or five years before realizing gains. Tore thinks it will be interesting to see how taking what has traditionally been an illiquid investment and turning it liquid – and this is why publicly traded REITS have an advantage. But because they also might have a lower return because you have a liquidity premium built into that investment because you can you can trade it on a daily basis. Tore sees things like block chain that might create an ability to securitize commercial real estate holdings and make it easily transferable and mark to market in a way that makes this investment type more liquid.

RELATED PODCASTS

395 Spencer Hilligoss, Co-Founder, Principal at Madison Investing

Last Updated on March 19, 2021 by Dr. Adam Gower Spencer Hilligoss, Co-Founder, Principal at Madison Investing Best Uses of Web, Social and Digital Media as a Real Estate Sponsor…

READ MORE >320 Melissa Gillham, Vice President Marketing, Origin Investments

Last Updated on June 22, 2020 by Dr. Adam Gower WHITE BOARD WORKSHOP Need More Money to Finance Your Real Estate Projects? Learn how to find more investors, raise more…

READ MORE >338 Hunter Thompson, Managing Principal, ASYM Capital

Last Updated on November 12, 2021 by Dr. Adam Gower FREE TRAINING What is Real Estate Crowdfunding? Learn how to build wealth and earn passive income in real estate while…

READ MORE >