NEW BOOK BY ADAM GOWER PH.D.

Capital Calls and RESCUE Capital

A guide to thriving during the coming real estate crash for real estate syndicators and their investors.

244 Jim Dowd, Founder, Managing Director, North Capital

Jim Dowd

My guest today is Jim Dowd and he is founder and CEO of North Capital. They are the leading broker dealer for online funding platforms that you've come to know and love. And Jim is going to explain to you today exactly what that means and what else it is that he does.

When I first spoke to Jim. It's got to be a couple of years ago. I really I didn't even know that Reg A was a financial instrument. I thought it was nothing more than a form of Caribbean music.

And so talking to Jim at that time was entirely baffling for me. So we tabled our conversation to do a redux and that is exactly what you are going to hear today from Jim.

Turns out that he and I actually have some overlap in our career path.

Read the transcript of my conversation with Jim Dowd below while listening along:

244 Jim Dowd North Capital.mp3 (transcribed by Sonix)

Gower: My guest today is Jim Dowd, and he is Founder and CEO of North Capital. They are the leading broker dealer for online funding platforms that you've come to know and love, and Jim is going to explain to you today exactly what that means, and what else it is that he does.

Gower: Welcome to the NationalRealEstateForum.org Podcast, Episode 244. Hey, thanks for joining me today. I am Dr. Adam Gower, and this is the National Real Estate Forum, where I speak to leaders of the real estate syndication industry so you can learn about the trends and practices in the industry, and so you can raise capital online.

Gower: When I first spoke to Jim, it's got to be a couple of years ago, I didn't even know that Reg A was a financial instrument. I thought it was nothing more than a form of Caribbean music. Talking to Jim at that time was entirely baffling for me, so we tabled our conversation to do a redux, and that is exactly what you are going to hear today from Jim.

Gower: Turns out that he and I actually have some overlap in our career paths. He was, and has always been a finance guy, and lived in Tokyo; apparently overlapping with me for quite an extended period during the 1990s. It's almost certain that he and I have met in the past, even if not on a professional basis. Tokyo is a very small community of expats.

Gower: Anyway, as always, I will include links to Jim's website and to his LinkedIn page in the show notes to today's episode at the National Real Estate Forum, or NREForum.org website. Just go to the top right on the menu tab, and hit Shownotes, and look for Episode 244. While you are there at NREForum.org, go ahead and subscribe to my news digest. It is the only digest in the industry that really concentrates exclusively on what is happening in real estate syndication, and crowdfunding. Go ahead, subscribe there: NREForum.org. You'll find it at the website, and you'll also find a link at the Shownotes page - Episode 244.

Gower: Jim is founder and CEO of North Capital Private Securities, and I'm just going to read this off his LinkedIn profile, actually: The leading broker dealer for online funding platforms, North Capital Investment Technology, which provides marketplace technology and services for online capital formation, and North Capital Inc., which is a registered investment advisor.

Gower: Jim has worked as head of the Hedge Fund Advisory, and Fund of Funds business at Bear Stearns. Before Bear, he was portfolio manager for Japanese convertible bonds. That must be when he was in Tokyo. Oh, no, previously, he spent nine years with Bankers Trust in New York, London, and Tokyo. That's where his my paths overlapped.

Gower: He started his career with Samuel Montague Capital Markets, a boutique investment bank in New York, actually with a storied history that goes back as far as my other book, which is, "Jacob Schiff and The Art of Risk." You can find out more about that at JacobSchiff.com, if you have the interest in that obscure piece of Japanese financial history. All right, without further ado, ladies and gentlemen, it's my pleasure to introduce Mr. Jim Dowd.

Jim Dowd: I came out of the finance business. I've been in the finance business my entire career. I started in the mid-'80s with a group in New York that was involved in the very early days of the interest-rate swap market, and was involved in putting together deals at a time when interest-rate swaps were essentially bespoke transactions. They were transactions that you would negotiate for a week or so, trying to put together the terms. taught me about the basics of structuring a deal, and of understanding some basic marketing, and how to put together the sides of the trade.

Jim Dowd: I was there with, it was actually a British merchant bank in New York called Samuel Montague. Eventually, got bought by Midland Bank, and then by Hongkong and Shanghai. I worked there for three years, and then I moved the Bankers Trust because, at that time, Bankers was one of the few firms that was approaching derivative products in a way that other firms were approaching securities markets; namely is traded instruments, where you would have market makers, and deal structures, and where the firm was willing to use a balance sheet to drive the development of a market.

Jim Dowd: I moved to Bankers Trust at the end of 1987, right after the stock market crash in October. Then, I spent the next nine years there in New York, London, and Tokyo, running different parts of the derivatives business. I started out initially as a trader, and then moved up in terms of responsibility, and ultimately ended up running derivatives trading in Asia or for the bank based in Tokyo. That was my first-

Gower: You were you in Tokyo-

Jim Dowd: I was-

Gower: When were you in Tokyo, Jim?

Jim Dowd: I lived in Tokyo from 1993 to 1996.

Gower: Oh, my goodness, we totally overlapped; I bet we met.

Jim Dowd: Is that right?

Gower: Yeah.

Jim Dowd: We very well may have. Which firm were you with?

Gower: Well, I ran a division of Universal Studios. I headed up all their real estate development-

Jim Dowd: Got it, okay.

Gower: -but spent most of my adult life out of the office in Roppongi, which I'm sure ...

Jim Dowd: Sure, yeah.

Gower: I'd imagine you found yourself there, as well.

Jim Dowd: I was never there. I definitely was never there.

Gower: You deny it. Lie, deny and demand proof, right?

Jim Dowd: Exactly.

Gower: All right. Very good. Well, that's funny. Did you pick up any Japanese while you were there, by any chance?

Jim Dowd: Very, very little. I could tell the taxi driver how to turn left, turn right, or stop here, and that's about it.

Gower: Well, that's also where I learned that there were three types of banker: those that can count, and those that can't.

Jim Dowd: Yeah, right. Exactly. Perfect.

Gower: All right, go on. You left Tokyo, and then what happened? How did you make your way to North Capital?

Jim Dowd: I left Tokyo. I actually moved to the buy side in 1996, and I became a portfolio manager for an arbitrage group in Hong Kong that was affiliated with a Japanese bank. We ran essentially proprietary capital for the firm, and I was the convertible bonds arbitrage who were looking at domestic Japanese convertible bonds, which, at that time, was a multi-billion-dollar market. Japan had the second-largest convertible-bond market in the world after the US, and it was a very ... Not a particularly efficient market. It was a market that was extremely well-suited for arbitrageurs. Because Hong Kong was in the same time zone, it was also a very easy market to trade from Hong Kong.

Jim Dowd: I did that in Hong Kong for about three years, again, and then I moved back to the US; actually, the West Coast - San Francisco - in 1999, with the idea of setting up a hedge fund that would essentially do the same thing. I did that for about five years, and ran, more or less, the same strategy, and had a little bit of success in the in the beginning, but ultimately not a great deal of success.

Jim Dowd: I decided in 2003-2004, wind that up, and go ... I had an opportunity to go to work for Bear Stearns, to essentially set up a Fund of Funds group. Rather than running money directly, it was an opportunity to allocate money to hedge fund managers. As someone who had originally come off the sell side of the business, understood fixed income and equities, understood derivatives, and had actually run a hedge fund for a period of time, I guess they decided that was a skill set that would help me do a good job evaluating managers, and separating the wheat from the chaff, so to speak, in choosing funds for the portfolio.

Jim Dowd: I was at Bear for five years, up until the very end, and I probably would have stayed there for the rest of my career, because it was a great place to work. I loved it there. I really enjoy the people I worked with. I loved the culture, and the 'eat what you kill' mentality. But events sorta took control in 2007, and then, in 2008, the firm essentially went off the rails and into the ditch. Then, the financial crisis happened, and that was the end of it.

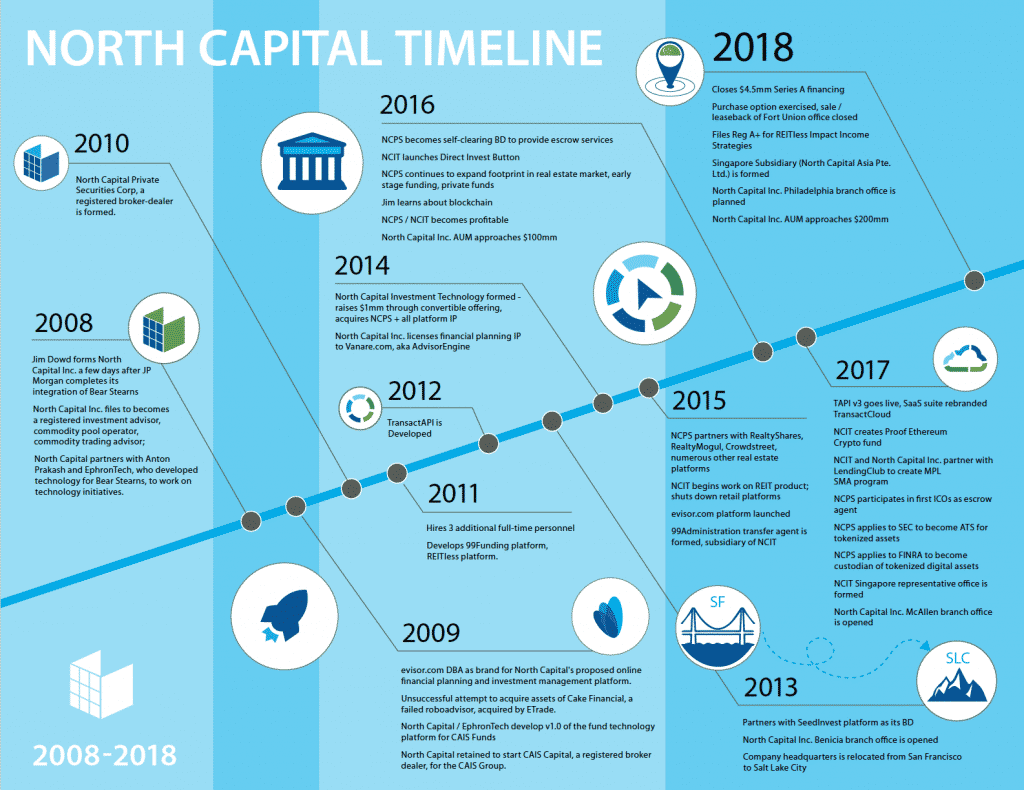

Jim Dowd: North Capital was born out of that. In 2008, after the firm had been acquired, I helped transition, and then wound up, in September of 2008, and started the firm on October 1.

Gower: What was the mission of the firm, Jim?

Jim Dowd: The original mission of the firm was essentially ... We set up as a registered investment advisor, and the mission of the firm was to bring institutional advice and portfolio construction to essentially retail investing.

Jim Dowd: The idea was that I'd been advising multi-billion-dollar families, and institutional investors specifically about alternative investments while I was at Bear. I realized that the quality of advice really went off of a cliff, when you started to move down market, and deal with emerging high-net-worth, and below-high-net-worth investors who really were not very well-served by the advice that they were getting.

Jim Dowd: I decided if there is a way to put together a business to create a systematic process around delivering that advice, and delivering those portfolios, then that ought to be something that has fairly low barriers to entry, because, at that time, we were in a significant financial crisis, and it wasn't very easy to be starting a business at that time. I also thought it would be highly scalable over time, and in fact, that's proven to be true.

Gower: The business, we started with that. Initially, it was just me, and then began to add some other people, as we started to get clients, and get some traction. Then, in 2010, I decided to set up a broker dealer primarily to enable the firm, enable me, and the people that I was working with to be able to offer products that were being managed by other folks, not just in an advisory capacity, but potentially through platforms, and doing some of the same types of things that we'd done at Bear Stearns, but in a more open-architecture framework.

Jim Dowd: Set up the broker dealer in 2010; got licensed in 2011. Then, in 2012, the JOBS Act happened. That really created a completely unexpected but very fortuitous opportunity for us, because, as , when the securities laws were changed, for the first time, general solicitation was permitted, and there was an explosion of funding platforms, and people raising money, using technology.

Jim Dowd: A lot of technology talent came into the industry, but there wasn't a lot of experienced finance folks at that time. We realized pretty quickly ... Initially, we thought we would build a funding platform that would compete with some of the early players in the business; some of the folks that you mentioned earlier. Then, we realized we're going to be ... If we take that approach, we are going to be under-capitalized, and under-resourced when it comes to marketing.

Jim Dowd: A better approach would be to focus on what we know, which is the financial side of things, and the technology, as it relates to compliance, and to build a platform that essentially supports the other platforms from a wholesale business standpoint. That's what we did. We reoriented our marketing from a B2C model to a B2B model, and we started to go after the groups like RealtyMogul, and RealtyShares, and [inaudible] and the various groups that were essentially in the process of transforming that part of the market.

Gower: If you want to raise capital for your deal, go to GowerCrowd.com, where I describe the seven key steps to raising capital online. That's GowerCrowd.com, and you'll find a link to the Seven Key Steps near the top of the page.

Gower: It's interesting. Prior to that, you were catering, or you were giving financial advice to retail investors, both as an RIA, as a broker dealer, but now you switched and became a tech service company, did you then, to platforms that were emerging out of the JOBS Act of 2012?

Jim Dowd: Actually, it didn't really quite develop that way. We continued to build the advisory business, and we kept it very much sequestered from the brokerage and technology business. Our advisory businesses continue to grow. We just celebrated our 10th anniversary a little bit earlier this year. We're up to over $200 million dollars under management, and that happened as an advisor.

Jim Dowd: That business has continued to grow, and expand organically, but what we realized was that the advisory business is really not a full-time job, unless you have ... Unless you're overloaded with new client prospects. It's very much of a business that grows through referral; it grows through doing a good job for your existing clients, and then hoping that they recommend others. Occasionally, you'll get inbound traffic, but it's really a business that, once you get your model up and working, and if you'll apply a little bit of technology, it can essentially grow organically, without being a 40-hour-a-week-for-multiple-people position.

Jim Dowd: We decided ... We were interested in the technology, anyway; we knew we had that skill set. We thought it would be a good oil for the advisory business, because it's the opposite. It's identifying prospective customers; it's outbound marketing; it's finding customers who need your technology at the time that they're ready to deploy. We've run it in parallel.

Gower: Give me the broad sweep. What were the products that you decided to develop for this emerging industry?

Jim Dowd: We focused primarily on the offering, and transaction process, and the technology associated with that. The main elements of that are the 'Know Your Customer,' or KYC. Sometimes it's called the Customer Identification Program, or CIP, which is a requirement that investment groups have to know who they're dealing with, and identify the client. AML [cross talk]

Gower: This is a compliance thing, right? This is a compliance, then, right? Yeah.

Jim Dowd: Yeah, these are compliance. These are compliance tests that we use to ensure that people, that investment companies, or anybody raising money knows the source of funds, and the clients that they're dealing with. Then we added to that the ability to generate, and sign documents online, which ... Now, everybody uses DocuSign, or EchoSign, but at that time, that was a ... It was fairly early into the process, and those technologies were not ubiquitous, so we built them into our technology platform. Then, we added payments, as well - the ability to transfer by ACH funds to settle subscriptions that were made into these private deals.

Jim Dowd: The way that we built the technology ... The other thing that we did that I think worked out well, and is proven to be a positive development for the business is that we set up the business as a series of API functions, so that we wouldn't require, and didn't require, and still don't require anybody to use our platform. They can simply call the functions through the API function set, and integrate the technology directly into their own platform.

Jim Dowd: For the big groups, who were already developing their platforms, and, in many ways, were more further along on the technology than we were, they didn't have to undo any of the work that they had already done, and-.

Gower: You were providing functionality in their workflow, basically.

That's right. That's right, and if they had certain functionality already built out, then that's fine; they could continue to use that, but if there were certain aspects of the technology that weren't built out, then they could take the functions from our technology stack, and build them in. Initially [cross talk]

Jim Dowd: Yeah, so, initially a lot of people were using us for just KYC, and AML. Then, when online payments started to be more commonplace, and more widely accepted, people started to use our payment stack. Then, at the end of 2016, we became a self-clearing broker dealer, which allows us to directly process payments, and to manage escrow accounts.

Jim Dowd: Then, we began to handle the entire payment, and settlement process, not only just collecting the funds, and transmitting them to a bank, but actually running the escrow, and ensuring that the contingencies associated with the offerings were met. All of that was baked into our technology stack.

Jim Dowd: Then, subsequent to that, just to finish the thought, we added two front-end add-ons to TransactAPI. One is called Marketplace-as-a-Service, and the other is called the DirectInvest button. The idea is to provide a front-end interface for groups that they want to be able to distribute securities through a platform, but haven't already developed the technology, don't have any desire to develop the technology. Then we can license the full technology stack, either for a collection of offerings, or for a single offering.

Gower: Is that what lies behind the Invest Now button?

Jim Dowd: Yep. The DirectInvest button is literally for a single offering at a time, and we actually have some groups who've done a half a dozen or more offerings, using successive buttons. The way that the architecture is set up is that if ... Let's say that you are someone that is either a serial issuer, which is what we call someone that does a lot of offerings in a given year, or a funding platform, meaning a professional intermediary that's trying to raise money for others, you can use a TransactAPI, either integrated with your technology, or you could use our Marketplace-as-a-Service, or you could use the DirectInvest button to actually control that entire fundraising process, soup to nuts.

Jim Dowd: It all integrates with the same TransactAPI back-end, which allows you to have a full audit trail on where each investor is in the process, who's accessed the system, how long they've been viewing documents ... Pretty much everything, soup to nuts, related to the offering process.

Gower: You white label it for your clients, do you? It's fully white-labeled?

Jim Dowd: That's right. The API functions don't even need to be white-labeled because they just get a [cross talk] background. Exactly, but, if someone wanted to have a front-end platform, then, the way we've designed Marketplace-as-a-Service is that it's completely customizable.

Jim Dowd: In fact, one of the earliest changes that we made to that stack was to build in a ... Build it as a module for WordPress, because we found that about three-quarters of the prospective customers who came to us had built their existing website in WordPress. By building the Marketplace-as-a-Service as an add-in for WordPress, it made it very, very easy to do a quick customization, and show people how the marketplace would tie into their existing branding, and development that they'd done. .

Jim Dowd: All of the security, all of the controls around the actual investing process are all part of the Marketplace technology, but essentially, WordPress acts as a wrapper for all of the content that we don't really have any need, or any desire to get involved with.

Gower: That's fascinating. You're just basically a plug-in with shortcuts, are you, on a WordPress site?

Jim Dowd: Yeah, that's ... It's not quite that nifty, but it's [cross talk]

Gower: -am I oversimplifying it?

Jim Dowd: -that's certainly the idea. That's our goal, actually. I think that if we felt comfortable with the native security of WordPress, then we would go that route, but, obviously, we're dealing with investor money; we're dealing with investor confidential information. We didn't feel that we could build all of that security around native WordPress security.

Jim Dowd: In a sense, we operate as a system within the system, but most of the groups that we deal with are using WordPress primarily because it's been an expeditious way to get their branding out, to tell their story, to develop their marketing collateral. As you know, there's a huge install base for WordPress, and hundreds of thousands of WordPress developers, so it makes it a very easy sell to say, "Look, if you already have an existing WordPress installation, you don't need to abandon that. You can simply layer on our Marketplace technology on top of it, and it's a pretty slick integration."

Gower: It sounds fascinating, actually. The two markets that you're appealing to are, one, those who are looking to set up their own platforms to intermediate between investors and developers. My space is exclusively real estate. I know that you're in some other areas, but in the real estate space, that would be somebody that either wants ... That wants to set up a platform, and attract investors and developers.

Gower: Then, on the other hand, you also provide ... Another market for you would be developers, themselves, would they, that have their own website, that have decided to go it alone, and want to raise money online. Is that right?

Jim Dowd: That's right, and I would say that it's not necessarily an either/or type situation. We actually have some customers who work with us. They also work with existing platforms to raise capital. What we've pretty much determined, or concluded from this first wave of online fundraising is that ...

Jim Dowd: The real fundamental issue that everyone is focused on is how do I ... If I'm a developer, if I'm a fundraiser, how do I get more access to capital, or how do I get access to cheaper capital? That can be an all-of-the-above strategy.

Jim Dowd: It may mean tapping the well of your traditional customers. It may mean accessing funding platforms that have an established network of investors, and it may be putting yourself out there with a platform to access new sources of capital. All of those things can coexist. It doesn't have to be one versus the other.

Jim Dowd: The great thing is that, given the change in regulations, and given the development of technology over the past few years, it's really quite cost effective to do all of the above. That's the way that we pursue it with our prospective customers.

Gower: Cost effective from the user's perspective to use your service - is that what you mean?

Jim Dowd: Yeah, from the issuer's perspective, because, if you think about it, most of the ... Let's say, in real estate, if a typical fee structure is, let's say, 1.5, and 20, or just as a ... It is a typical-type fee, and obviously carried interests vary all over the place, and management fees vary from one to two percent [inaudible] If you're talking about a typical-type fee, and you're making 1.5% on a million-dollar investment, you've got a $15,000 incremental revenue from that investment in that fund just from your management fees.

Jim Dowd: Really, that's around the starting price point to be able to set up one of these platforms, or at least to be able to set up a DirectInvest button for an individual offering, you could do it for quite a bit less than that.

Jim Dowd: If you think about, in the old days, whenever you talked about ... Whenever anyone would talk about setting up a platform, or doing any kind of a broad-based retail marketing, you would be talking about half million dollars in legal fees, and even more in technology charges. Now, because of the developments over the past five years, costs have come down quite a bit. A lot of the technology is pretty well-disseminated, and it really becomes a fairly easy lift for someone to say, "Yeah, I'll give it a go," because they don't have to raise that much money through an online platform to basically pay for the costs of experimentation.

Gower: That's interesting. You're talking about, again, the back end for actually processing an investor, once they click on the I Invest, or Invest Now button, right [cross talk]

Jim Dowd: -or just licensing that technology. The way that we tend to look at things is based on what's my marginal cost to have access to this technology, versus not having the access to the technology. If you think that having access to the technology will give you marginal access to additional investors, then it becomes a fairly easy decision to make.

Jim Dowd: If you're not planning to generally solicit; if you're planning to simply access the same investors that you would ordinarily access, then, yeah, the value proposition's a little bit different. Then it would be looking at does the conversion happen more quickly? Is the information ... Do I get cash in the bank quicker? Things like that. Certainly, if the if the goal is to attract new investors, to expand the reach of your offering, then it becomes a much simpler value proposition.

Gower: Right. Two questions come out of that. One, just so that I understand exactly what it is that we're talking about, there is no function of ... There is no broker-dealer function in this at all, is there? This is strictly AP.

Jim Dowd: In what we're talking about right now, that's correct. In a lot of cases, we'll bundle broker-dealer services with that, because a lot of times, the way that people come to us originally is that they're looking for broker-dealer services, or they've decided that they want to distribute beyond their own immediate circle, and they want to sign selling agreements, and they want to reach out more broadly.

Jim Dowd: Maybe, if they want to do general solicitation, they want to be able to solicit, but they don't want the regulatory risk that's associated with that, or they'd like to offload that to someone else. That's where the broker-dealer functionality comes in. A lot of times, we'll get involved that way, as well.

Gower: Now, when you do that, does that involve broker-dealer fees does it? That's a totally different financial model.

Jim Dowd: It does. Generally, what we've tried to do is create something of an à La Carte pricing model for the broker-dealer fees based on what type of services a particular issuer wants us to provide. If they want us to essentially oversee an offering, supervise sales personnel, be involved in qualifying the offering in various states, things like that, then it's going to be one fee. If our role is more limited, let's say, to reviewing accredited status for accredited investors, and doing KYC, and AML, and handling payments, then it might be a much more limited-type role.

Jim Dowd: What we've tried to do is make the pricing tied to the degree of services, and the degree of risk that we're taking in assuming that role with a particular deal. As you might imagine, a lot of the existing platforms have gotten very good at figuring out what they want to do themselves, and what they want to outsource. We're constantly under pressure with regard to fees to make sure that we're keeping pace, and keeping tight pricing, relative to the other broker dealers in the space, and relative to other service providers who might be able to do the same thing for less money.

Gower: In a sponsor's perspective, rather than from a platform's perspective, there are two reasons why I might come to you. One is simply for back end. We've talked about that, just the processing of the transactions, essentially. Then, the other from the broker-dealer perspective, I might come to you, and say, "I've got a deal at the corner of Walk and Crosswalk. Can you do everything for me, including raising the money?" Is that right? Is that what it means to offer the broker-dealer function, as well?

Jim Dowd: Yeah, those would certainly be two extremes on the continuum. I would say that the additional ... It's never quite that simple, because, generally the sponsor will want to retain a high degree of control in the way that an offering is distributed. They might say, "Hey, I have this existing collection of individuals that have invested in my previous deals. I don't want to pay you to simply process, to just take orders on their subscriptions, because I already have a relationship with those investors ..." but maybe they want us to verify their accredited status, as a part of the overall deal, because this is the first time that they're doing a 506(c) deal, let's say.

Jim Dowd: In some cases, we have groups who say, "Look, I feel like I've got the US pretty well-covered, but I'd really like help with international distribution." We have several groups that we work with that are affiliated with North Capital that are distributing securities in China, in South Korea, and in other parts of Asia that are primarily providers of capital, and consumers of investment opportunities. That's a natural symbiotic relationship between the investor side and origination side.

Jim Dowd: Then, the other thing that's happening now is, as we're going into this next phase of development for online fundraising, people are starting to look at things like secondary trading, and tokenization, and broader distribution, still, through some of the standardization that's starting to happen as a result of the block chain movement, and security-token standards, and things like that, and we're very much involved in those aspects, as well.

Jim Dowd: Right now, I don't think it's a reason for anybody to work with us as opposed to anybody else, but six months from now, I think it'll be a completely different story, because the market is continuing to evolve, and we're hopefully trying to continue to evolve with it.

Gower: That's really interesting, secondary markets of exempt securities.

Jim Dowd: Yeah, that's definitely coming. We have an ATS, which is an alternative trading system, which is like a private stock exchange. We originally filed for approval with the SEC back in the summer of 2017, and it took us about a year for the application to be accepted by the SEC. Now, our application has been accepted. We're in the list of ATSs that are on the SEC website, and we're currently working through the regulatory process with FINRA, which is our industry self-regulator, to obtain the required approvals to be able to do those listings.

Jim Dowd: This is the promise that we've had for securities like Reg A+, and seasoned Reg-D issues, and things like that. Reg A+ securities are not restricted, so, theoretically, you could invest in a public non-traded Reg A+ REIT, on Monday, and decide to sell it on Wednesday. The problem right now is there's no place to do that.

Jim Dowd: Traditionally, non-traded REITS are just that - they're not traded. I think our goal, and the goal of a number of the folks that have a similar world view is to create secondary-trading venues that will allow for more liquidity on Reg-A+ transactions, as well as seasoned Reg-D offerings, and the like.

Gower: What's the seasoned Reg-D offering? [cross talk]

Jim Dowd: That's a great question. Reg-D securities are restricted. When you agree to invest in an offering that is exempt, under Reg D, then you get what's called a legended security, or security with a ... I guess I just created an adjective out of that. I don't know if that's a real adjective, but ...

Jim Dowd: You get a security that has a legend that says you agree that you won't transfer these securities, except under limited circumstances, for a one-year period. After that one-year period, you're no longer restricted; you're free to sell them. The problem, again, is that it's great in theory, but there's no place to actually do that. There's no secondary exchange where you can go, and easily, and cost-effectively market those seasoned Reg-D securities.

Jim Dowd: That's the problem that people are trying to address. There have been some cases in the past ... Barry Silbert at SecondMarket did a terrific job in getting that started, but, even those pre-IPO unicorn deals, when those were being transacted ,they weren't real pure secondary-market deals, because there were always new vehicles that were being created to hold the secondary shares. What we're talking about here is real secondary trading of shares that have been issued for longer than a year.

Gower: I think Woodie Neiss is working on something like that, as well.

Jim Dowd: Yes, yes, in fact, he is working on at least one thing that I am aware of, because we're working on it with him. He has a company called Guard, in which we were a seed investor, and partner in putting together the plan. It's to address a particular problem related to secondary trading of securities, which is [cross talk] the limited disclosure, and then the state blue-sky rules, exactly.

Jim Dowd: That's a very significant barrier to secondary trading that we believe that Guard will provide a solution to. He has done terrific work in getting that company essentially ready to deliver the service. There's an arrangement with the business arm of the AICPA, which is the American Institute for Certified Public Accountants, that basically is working to ensure that the data that the firms disclose actually is legitimate data, and not made up. The partnership with RIVIO, which is a part of the business arm of the AICPA, AICPA.com, is helping to do that vetting, and that validation. That's exciting stuff that he's working, on for sure.

Gower: What are the biggest challenges for you at the moment? What are your highest priorities going into 2019?

Jim Dowd: I think navigating the regulatory landscape is a consistent, and always an important challenge, simply because we always want to make sure that we're doing ... Staying within the lines, staying in bounds. On the other hand, we want to make sure that our competitors do, as well.

Jim Dowd: To the extent that a lot of these markets have competitive aspects to them, we need to make sure that we're doing everything we need to do to stay competitive, and, at the same time, stay inside the lines, and make sure that we understand, also, where the market is going. I feel very good about that. I feel like there are a lot of people who have been very critical of the regulators, and how long it's taken to get guidance on this or that.

Jim Dowd: I actually have a different take on it. I think that part of the problem that has affected the industry is that there's a hundred different ideas being thrown at the regulators by a hundred different firms, and they can't really give guidance on everything.

Jim Dowd: They're essentially charting a path that we believe will allow us, and some of the other folks that are involved to develop these markets in a thoughtful, prudent way that protects investors, but still offers some of the benefits that we're looking for, in terms of secondary markets, and liquidity transparency, access to new investors, things like that. I think regulatory is always on the list.

Jim Dowd: I guess, the second thing ... I always worry just about market conditions, particularly in an environment where there has been rapid growth, and there's been a lot of issuance that's happened that, frankly, are deals that probably never should have been funded; never should have been launched to begin with..

Jim Dowd: Warren Buffett always says that until the tide goes out, you never really know who's been swimming naked, and there's ... I think you're seeing a lot of naked swimmers wash up on the beach right now, given everything that's happened with the decline of crypto markets. There's been a lot of hype, leading up, and even throughout this bear market, so I worry about market conditions.

Jim Dowd: Apart from those things, I'm incredibly bullish on the technology, and on the progress that's been made, and that I think will continue to be made to bring additional liquidity, and additional access to these markets. I think that things are ... When I think about the early days that I was involved in private markets, versus today, it's just shocking to me how much technology has helped drive down transaction costs, improve access, shorten the settlement cycle. Just a lot of very positive things, both for investors, and issuers.

Gower: As far as goals for the company, these three products that you have - Market-as-a-Service, DirectInvest, and TransactAPI - are these product lines that you're looking to really concentrate on in 2019?

Jim Dowd: Yeah, we've seen very good organic growth in what we call the transaction-services part of our business, which is really where those products reside, in addition to the broker-dealer services, and that, that we provide.

Jim Dowd: Part of that is obviously going to be cyclical with the market. As transaction volumes slow down, they're going to slow down for us, as well, but the organic growth with new platforms coming in, with new issuers being interested in the technology, and in accessing new forms of capital, I think that's going to continue.

Jim Dowd: We're seeing much ... Even in the past 12 months, we've seen a lot of very serious real estate developers start to look at these technologies, and figure out ways to use them in their business. I think that's going to continue..

Jim Dowd: We're also looking at ... We've got two other parts of the business that are just beginning to get started. One is custody, which we have grown out of our escrow business. We plan to have that be launched in full swing next year. We've done some limited work on it in the fourth quarter, but really, by first/second quarter of next year, that's going to be fully launched, and rolled out, and a growing part of our business.

Jim Dowd: Then, we have this third leg of the business, which is directly related to the original advisory business that we first talked about, which we're calling our managed-assets business. That's really about creating a public-pooled product to be available for investors.

Jim Dowd: We've launched a Reg A+ publicly available non-traded REIT, which is focused on income strategies, and impact. That was qualified by the SEC about two months ago, so we're just getting going with that. We think we'll have some additional Reg-A+ products coming out, and some additional fund products.

Jim Dowd: We see this as a ... It's the third leg in a three-pronged part of the business, which includes the transaction piece, the escrow, and custody piece, and then the managed-asset piece. We're excited about those, as well.

Gower: The managed-asset piece, the Reg-As, this is you as sponsor, is it, Jim, or this is ...?

Jim Dowd: That's right, yeah [cross talk] That's right. We're actually managing the fund, and we will both be an investor for some of our partners on the platform side, because we'll be a consumer of some of the product that they're creating.

Jim Dowd: Then, because we've built up this capability to do research and analysis around these types of real estate opportunities, we feel like it's a natural way to extend what we're doing into actually managing the assets, and being a sponsor directly [cross talk]

Gower: A real estate sponsor.

Jim Dowd: Just on the real estate side, exactly. Just on the real estate side, initially, and then, eventually, as I mentioned, we're going to doing some other things in public funds, but all connected to our core business. We don't want to move in a direction, where we're just ... Where we want to become a broad-based asset manager, or anything like that.

Jim Dowd: We're looking for opportunities, where we have a particular skill, a particular edge, and we think we can add alpha, relative to what else is available in the market. This is one where it's this unique combination of developments in the market, and developments in the particular market sectors that we're looking at, and we're enthusiastic about what we can do with it.

Gower: What are the key daily habits that you have, personally, that make you, and your business successful, and productive?

Jim Dowd: The first thing is that I always keep the first two working hours of the day open, because I never know what's going to happen when I walk into the office, or even before I get to the office. I don't want to have ... I don't want to not be able to react to what's happening that's new, that's unanticipated. I would say that's been one factor is to always keep the first two hours of the day open. Some days, those first two hours are 6:00 to 8:00, and some days, it's 7:00 to 9:00, but keep the first two hours open.

Jim Dowd: The second thing I would say is schedule meetings for 30 minutes, rather than an hour, because it's easy to allow a good meeting to go longer, but, if you're having a terrible meeting, it's oftentimes very difficult to get off the phone after 30 minutes, unless you've scheduled [cross talk]

Gower: Thanks so much. I just had to check how long we've been talking, to see [cross talk].

Jim Dowd: No, this is a great call. It's a great meeting. Did you ask for three, or did you just say what are the habits ...?

Gower: No, no, just that's question number one of three [cross talk]

Jim Dowd: -okay, those are the two ... Okay, got it. Yeah, those'd be the two.

Gower: -here's question number two: in real estate, and especially as you're migrating now to real estate sponsorship, and my whole focus is real estate, let me ask you this - what's been the hardest lesson you've learned in real estate?

Jim Dowd: The hardest lesson that I've learned in real estate is, I would say, also the hardest lesson I've learned in business over the past 30 years, which is that people lie a lot more than they should..

Jim Dowd: When I started in the business 30 years ago, I was dealing primarily with financial institutions, British merchant bank - 'My word is my bond.' We were doing hundred-million-dollar transactions, even billion-dollar transactions on the telephone without a taped line, and you pretty much knew the people that you were dealing with. You knew that if they said they were going to do something, then they were going to do it.

Jim Dowd: What we've found, I would say, in the past 10 years is that the barriers to entering that club, or entering that framework have dropped, and you get a lot of charlatans, you get a lot of liars, you get a lot of pathological people, who you just can't trust.

Jim Dowd: The need to run background checks, and assume the worst in people, in a lot of cases, unfortunately, is just the reality, because unless you take steps to protect yourself, you're going to likely end up on the wrong end of a transaction without any recourse.

Jim Dowd: I would say that's the hardest lesson is ... I'm not so jaded that I've lost faith in mankind, or anything like that, but I just think you have to be careful, in a way that, 30 years ago, maybe I didn't have to be quite so careful.

Gower: Truly interesting. Actually, the way you described how it was 30 years ago is exactly how it was 120 years ago [cross talk] the way that they used to trade, and it's really incredible. Maybe it's just the advent of technology that's really screwed everything up [cross talk]

Jim Dowd: Yeah, you wonder, right? I really do wonder, because I remember when I was first starting out, and I was a puppy. I was 21 years old. Basically, there was always an expectation that if you said something, you had to live up to it, even if you lost money; even if it cost you your job, whatever, because, it might cost you your job, but it wouldn't cost you your career; whereas, if you reneged on a deal, or you backed away from something, it was it was the kiss of death.

Jim Dowd: right.

Gower: Right, and now you can just create an avatar online, and become somebody else [cross talk]

Jim Dowd: Exactly. You read these stories about people doing just that, and it's shocking.

Gower: It is shocking. All right, last question; actually, we're back to my part ... If you could give one piece of advice for somebody who has not yet invested in real estate, but is considering investing in real estate online - online deals - what would that advice be?

Jim Dowd: I would say that if you see something that looks too good to be true, then it probably is. Make sure you work with a trusted partner, but also make sure that you are prepared to do work yourself. Read the materials that are provided; check for accuracy; check for consistency. If you see things that seem inconsistent, that don't seem right, trust your judgment.

Gower: If you are a sponsor, and you are looking to raise capital online, then Jim is going to be a very important contact for you. As he has described, he has platforms that will provide you with all the back-end functionality that you need to be able to manage investors' capital, once they have converted, and become actual investors.

Gower: He is a wealth of knowledge, not only about real estate crowdfunding, and online capital formation, but about finance and financial structure, overall. I do, with confidence, suggest that you go ahead, and check out his website, and his background, and feel free to contact him. You can find all the information for how to do that at the Shownotes to today's episode, at the NationalRealEstateForum.org website, NREForum.org. Go to the Shownotes tab, top right, and search for Episode 244.

Gower: In the next episode, my next conversation is going to be with Jeremy Roll, and Jeremy actually is a professional real estate investor. He's been doing that for donkey's years, actually. and has some incredible insights based on the experience that he's been through investing in real estate, not only directly, but also through deals that he's found online.

Gower: He and I also share the same long-term perspective, and concerns about where we are currently in the real estate cycle, and the market sites. Be sure not to miss that episode. You can find links, actually, to how to subscribe to the podcast, at the NREForum.org website. I think it's somewhere on the front page, there, you'll find some links. Go ahead, and subscribe, and don't miss a single episode.

Gower: That's it for today. Thank you for tuning in, and thank you Jim Down, Founder and CEO at North Capital, for taking the time out to record this podcast with me. Until the next episode, this is Dr. Adam Gower signing off.

Sonix is the best online audio transcription software in 2019.

The above audio transcript of "244 Jim Dowd North Capital.mp3" was transcribed by the best audio transcription service called Sonix. If you have to convert audio to text in 2019, then you should try Sonix. Transcribing audio files is painful. Sonix makes it fast, easy, and affordable. I love using Sonix to transcribe my audio files.

Jim was and has always been a finance guy and lived in Tokyo apparently overlapping with me for quite an extended period during the 1990s. So it's almost certain that he and I have met in the past even if not on a professional basis. Tokyo is a very small community of expats.

Jim is founder and CEO of North Capital Private Securities.

North Capital Private Securities is the leading broker dealer for online funding platforms North Capital Investment Technology which provides marketplace technology and services for online capital formation and North Capital Inc. which is a registered investment advisor.

Jim has worked as head of the hedge fund advisory and fund of funds business of Bear Stearns.

Before Bear he was portfolio manager for Japanese convertible bonds. He previously spent nine years with Bankers Trust in New York London and Tokyo. That's where his and my paths overlapped, and he started his career with Samuel Montague Capital Markets; a boutique investment bank in New York.

Actually Samuel Montague is a bank with a long history that goes back as far as my other book which is Jacob Schiff and The Art of Risk.

Leaders of The Crowd

Conversations with Crowdfunding Visionaries and How Real Estate Stole the Show

Discover how laws that gave us crowdfunding were solely meant to finance small companies and yet inadvertently opened the doors to allow you to invest in real estate like never before.

Read the book and listen to the actual conversations.

RELATED PODCASTS

328 Yonah Weiss, Cost Segregation Expert at Madison SPECS

Last Updated on March 9, 2021 by Dr. Adam Gower NEW BOOK BY ADAM GOWER PH.D. A BRAND NEW WAY TO FINANCE REAL ESTATE …No matter how many investors you…

READ MORE >340 Michael Campbell, CEO of The Carlton Group

Last Updated on September 15, 2021 by Dr. Adam Gower WHITE BOARD WORKSHOP Need More Money to Finance Your Real Estate Projects? Learn how to find more investors, raise more…

READ MORE >350 Spencer Levy, Senior Economic Advisor for CBRE and Chairman of Americas Research

Last Updated on June 22, 2020 by Dr. Adam Gower FREE TRAINING What is Real Estate Crowdfunding? Learn how to build wealth and earn passive income in real estate while…

READ MORE >