FREE TRAINING

What is Real Estate Crowdfunding?

Learn how to build wealth and earn passive income in real estate while someone else does all the work.

012 Housing Stock Woefully Undersupplied, Affordability Diminishing

Jordan Levine...

... Economist at the California Association of Realtors talks about the state of the housing market nationwide and in California, observing that there is considerable house price inflation, but that the amount of housing stock that is turning over has reduced considerably. As baby boomers are overhoused, preferring to age in place than to sell and purchase smaller, much more expensive homes, and the population increases, far more agents are competing for a smaller market than ever before.

Severe Housing Supply Restraints

The housing market saw a good start in 2017. California saw strong growth of around 4-6% in home prices at the beginning of the year, which is good, but only around 420,000 sales in the volume terms which is the same as it has been over the last 7-8 years, which is not good. Indeed, this level of inventory is about the same as during the 1990’s when the economy was much smaller and with a much lower population and far fewer jobs than there are today. This speaks to the difficulties consumers have in finding a home (more consumers, less transactional volume relative to the number of people looking), and also to the challenges real estate agents face in competing in the open marketplace. In fact there are over 65,000 more licensed RE agents/brokers in California today than there were in the mid-1990’s, yet they are handling the same transactional volume.

This issue is one of limited supply in California. Economically the state has outperformed the national economy for over 6 years, in terms of new jobs and income growth. Consequently there is considerable demand for housing, but little supply and so prices are being driven up relentlessly to the point that they become unaffordable. This forces people to choose between being a homeowner or buying far away from jobs and having a two hour commute each way to their places of work. Remarkably, the number of homes available for sale on the MLS state wide (Q1 2017) is 16% lower than it was last year, and yet sales growth is up 2.6% - presumably meaning that what is on the market is selling very quickly relative to last year – another indicator of very strong demand relative to supply. This may be partially as a result of consumer concerns about rising interest rates, with buyers moving rapidly to purchase what is on the market quickly to avoid being caught with higher rates. So this begs the question whether or not the pace of sales growth can be sustained as rates start to rise as people feel the urgency to buy ahead of rate hikes diminishes.

Leaders of The Crowd

Conversations with Crowdfunding Visionaries and How Real Estate Stole the Show

Discover how laws that gave us crowdfunding were solely meant to finance small companies and yet inadvertently opened the doors to allow you to invest in real estate like never before.

Read the book and listen to the actual conversations.

Inventory Low Especially at Lower End of Market

Another indicator of the lack of inventory is the amount as measured by months of supply. This is a metric used that projects the amount of time it would take for all existing homes on the market to be sold out if no other homes were put on the market. As of syndication of this episode [Q1 2017], supply is around 4 months where historically it is more common to see 7-8 months i.e. supply is running at half what it would be excepted to be. This is a particularly acute problem at the bottom of the market. If you break that out by price levels, you see that below $500,000 price level, supply is at 3-3.5 months, whereas for properties selling at above $1MM, supply is much higher at around 11 months. What this means is that at the lower, entry level end of the market, the demand is extremely high, and supply very low. Sales in the below $500,000 level are down over 20% and over since last year – simply because the supply is not there.

Demographics a Significant Factor

Demographics is a huge part of the problem. Historically, we have seen turnover at around 8% i.e. of the total housing stock, 8% will sell in any given year, but that is currently around 4.2% - half what it used to be. Many long term homeowners, with over 70% of all homeowners 55 years old and above, have not moved home for almost 20 years. For the first time in 30 years of conducting research on how long people own a home before selling, C.A.R. discovered that the average time homeowners stay in a home is over 10 years – instead of the 5 years as it used to be. Baby-boomers do not want to move on even though they are living in homes that are too large for them. Interest rates are at an all time low, pretty much, so most folk who can, have refinanced so the prospect of moving – and taking on higher rate debt – is not so attractive.

Tax Policy Contributes to Inventory Restraints

Governmental policy and structural challenges that incentivize people to stay in their homes also play a role in squeezing down inventory. The Prop 13 factor (tax) dis-incentivizes homeowners from selling. Prop 13 restricts property taxes to a set percentage of the last sale price, plus a maximum 2% increase per year. With property prices rising as much as they have, there has been a de-coupling between home values and property taxes. This means that moving to a new home at a much higher price (even if the prior home can be sold for far more than the original price and for the same as the purchase price of the new home), results in a dramatic increase in property tax liability as the basis has now increased to market value. Thus the incentive is to stay in your home rather than move. So the trend has been to pump money into existing homes with remodeling work, rather than to move to a new, perhaps smaller, home. All indications is that low turnover and tight inventories are, perhaps, here to stay, at least for the foreseeable future.

How to Fund Your Deals

7 Steps to Raising Equity Online

Single Family Home as Rental

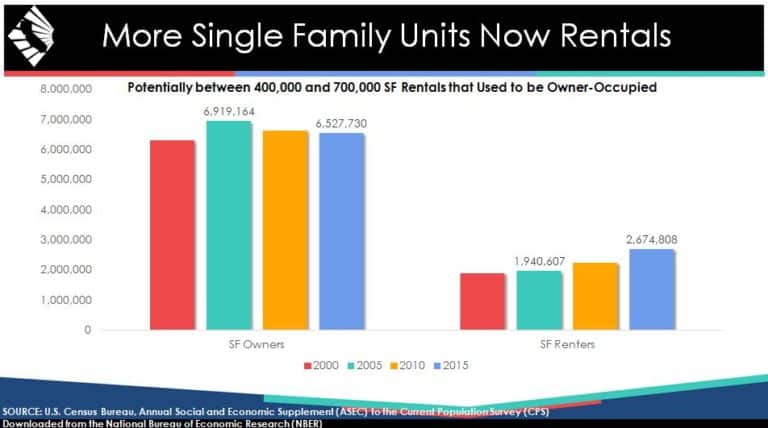

In addition to the fundamental lack of new construction to accommodate demand is the switch during the last recession from homeownership of single family residences, to rental of these same properties. Vacancy rates for these homes are amongst the lowest in the nation, and rents are being driven up. Homeownership was just not an option for a lot of people coming out of the great recession because of tarnished credit due to bankruptcies or foreclosures, so this cohort was forced into becoming renters. C.A.R. estimates that upwards of 700,000 single family homes were taken out of the ownership pool and put into the rental pool as a result of the last downturn, further restricting inventory available for sale. C.A.R. sees upward pressure on rents to continue signaling even more demand for single family homes as rentals rather than for ownership.

Demand Exceeds Supply - Affordability Suffers

There is a need for at least 170,000 new units per year to be built (in California) just in order to stay level with population growth, not including the accumulated housing deficit that has been building up over the decades. Unfortunately, this volume of construction has not been seen since 2005 so the deficit just keeps on building. This factor adds further to the affordability problem that Californian’s face for housing. Affordability is a measure of the relationship between average income with the cost of paying a mortgage when buying a home for the median home price. The house is deemed affordable if the homeowner is using 35% of their total income to pay the mortgage – i.e. if a homeowner is paying over 35% of their income on the mortgage they are deemed to be ‘house burdened’ and the house is not affordable for them. Currently, the affordability level in California is only 31% meaning that only that percentage of households can afford to buy a house by this measure. California is particularly expensive, with the rest of the nation enjoying, on average, 60% affordability by the same measure.

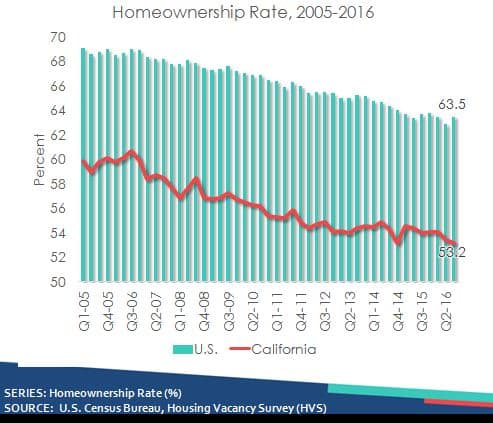

California Becoming a Majority Renter State

There is a continuing trend for affordability to head down, especially with interest rates going up, it could be possible that only 25% of California homeowners could afford to buy a media priced home in the state. This would be an all time low. The problem is accentuated by the lack of development of new homes. Since 2010, Los Angeles county has added around 483,000 new jobs, but only permitted around 100,000 new homes. Even this might be misleading on the permitting side because some of those 100,000 new home permits were, in fact, for replacement of older homes that were torn down, and so consequently not adding to housing stock. Not a net gain of new houses, but it is a net gain of new jobs. This even further exacerbates the housing affordability crisis in California and, especially if mortgage rates hit 5% or 6%, affordability could drop to below 25% of households – especially as prices continue to rise due to high demand and under supply.

With homeownership dropping to historic lows, California is moving towards becoming a majority renter state.

RELATED PODCASTS

334 Guy Kawasaki Remarkable People Podcast

Last Updated on September 15, 2021 by Dr. Adam Gower FREE TRAINING What is Real Estate Crowdfunding? Learn how to build wealth and earn passive income in real estate while…

READ MORE >342 Richard Ormond, Attorney & Shareholder, Buchalter

Last Updated on September 15, 2021 by Dr. Adam Gower WHITE BOARD WORKSHOP Need More Money to Finance Your Real Estate Projects? Learn how to find more investors, raise more…

READ MORE >307 Brent Hieggelke, CMO CrowdStreet

Last Updated on September 15, 2021 by Dr. Adam Gower WHITE BOARD WORKSHOP Need More Money to Finance Your Real Estate Projects? Learn how to find more investors, raise more…

READ MORE >