Janney Issues Positive Outlook For US Real Estate in 2022

After the 20+% gains seen in commercial real estate in 2021, a repeat performance in 2022 may not be possible, but another leg of the property bull is still probable, advised Janney Montgomery Scott, the Philadelphia-based wealth management firm.

The sectors that were such stand-out gainers in 2021, including apartments, storage facilities and industrial properties, promise again to reward investors, said Janney, in their 2022 real estate investment trust (REIT) outlook, issued in January.

For commercial property as a whole, and for REIT investors, returns of 10% are likely in 2022, including a 3% dividend yield, advised the brokerage.

The imponderables in 2022 are for Janney as they are for all investors: What will happen to interest rates and global economic growth in the coming seasons?

Barring major untoward events, Janney expects interest rates to creep up in 2022, but not by leaps and bounds, and anticipates “solid” job growth in the year. Inflation could remain elevated through 2023. In this environment, properly selected commercial property will more than hold its own.

It is important to highlight that Janney is reviewing the 2022 outlook for publicly listed REITs, which are indeed suitable investment vehicles for many investors. However, REITs tend to have large portfolios that can be improved or culled only slowly, and which are generally leased up at any time.

In sharp contrast, investors in crowdfunded real estate syndications can participate in single-property development, upgrade or turnaround projects, with prospects for larger returns. In addition, there are syndications of small, targeted portfolios. Fresh leases can signed as a syndication nears completion or liquidation date, capturing the upsides of inflation for investors.

The Best Sectors in 2022

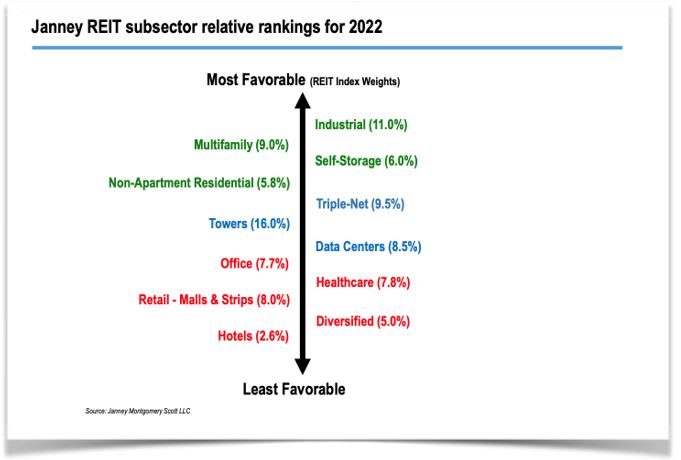

Little surprise is in store for 2022, with the industrial-warehouse, multifamily and self-storage sectors expected to outperform commercial property in general, just as those sectors also did in 2021, forecast Janney.

As it has in recent years, the industrial-warehouse sector will benefit from e-commerce, as well as precautionary storage by manufacturers, retailers and others squirreling away extra product in an era of supply-chain snags, expected Janney. The only yellow flag on the sector is that it may be overbid.

The multifamily story in 2022 is similarly well-understood, with rents rising even more rapidly than inflation in 2021. Apartment rents rose by 11% in 2021, reported Dwellsy, a residential-rent marketplace. The apartment sector has a big advantage in comparison to office towers, in that most multifamily leases are one-year or even six months in duration. And everywhere, providing new apartment supply can be challenge, due to city permitting, land scarcity and even labor shortages. “Developments remain challenging given land, material, and labor costs (as well as the ability to find enough labor),” said Janney.

Self-storage units will remain in demand in 2021, as the home-buying dream is delayed, but consumers and families need “a garage” so to speak. The West and South are the most favorable markets.

The office market will generate positive returns in 2021, and even more so for selective buyers, said Janney. Though the office sector is not as hot as apartments and industrial, prices are considerably softer. Certain Sunbelt markets will fare better than national averages. The big uncertainty is the Omicron variant of COVID-19, and whether it passes quickly so that world of white-collar workers can finally get back to normal, said Janney.

The hotel sector, aka hospitality and lodging, still has a checkered outlook for 2022, contended Janney. A concern is that business travelers have learned to zoom online rather than into the sky at an airport. Obviously, all travel outlooks are vulnerable to renewed government edicts regarding crossing national borders. Still, the price may be right for those inclined to try their hand as hoteliers, or investors therein.

Retail space is another challenged sector in 2022, given the ongoing explosion of online shopping, and recurrent pandemic-related government restrictions on business hours and permissible density. Grocery-store anchored strip malls may do better than the big malls, said Janney. Another positive is the “wall of private capital” seeking a home in real estate, and hunting for out-of-favor properties, which includes retail.

Healthcare and senior-housing properties are obviously well-positioned in terms of aging US demographics, although staffing shortages and higher pay at senior facilities could undercut how much operators can afford in rent, noted Janney.

Farmland, single-family detached portfolios, data centers and other specialty properties all should appreciate in 2022, though much depends on case-by-case specifics, said Janney.

Conclusion

Commercial real estate has long been the profitable refuge in times of inflation, and 2022 promises to be no different.

Given the general difficulty of property development in 2022, and yet the large amount capital globally seeking a home, the supply of property to the renting market or available for investment looks thin—a seller’s market.

While REITs will likely do well in 2022, investors bringing discrete or small-portfolio quality product to market in coming years could score even larger returns—including investors in crowdfunded real estate syndications.

Get access to our FREE weekly newsletter exclusively covering the latest updates from the real estate crowdfunding world